Table of Contents

The flagship cryptocurrency, Bitcoin, has hit $100K after a dramatic bullish run that started in the post-United States presidential election. The coin, which first rallied above the $80K mark immediately after the declaration of former President Donald Trump as the election winner, had an impressive price trajectory.

It flirted with $100K on November 22, when it traded at over $99,000. However, as BTC had some minor retracement correcting to key support levels of $90,000, its resurgence had propelled it to crack the once-thought mystical valuation of $100K on December 5, rallying over 140% in 2024. Bitcoin also set a new all-time high of over $103,000. At the time of writing this article, Bitcoin trades at $103,279, up by 7.65% in the past 24 hours.

Therefore, let’s explore the drivers of this historic price surge that has smashed ceilings and brought the predictions of some analysts and experts to fruition.

Drivers Of Bitcoin’s Historic Price Surge

1. Trump’s Appointments

The news of United States President-elect Donald Trump picking Paul Atkins as the Chair of the Securities and Exchange Commission (SEC) in the Trump 2.0 administration has triggered optimism in the crypto market. Atkins has served as the co-chair of the Chamber of Digital Commerce’s Token Alliance, and Trump stated that he “recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before.”

Recall that the current SEC Chair Gary Gensler, widely viewed as a crypto critic, has revealed his plan to step down on January 20, 2025, when Trump is inaugurated. His decision came after Trump vowed to sack Gensler on his first day in office.

Trump has also nominated Cantor Fitzgerald CEO Howard Lutnick to head the Department of Commerce. It is expected that Lutnick, a vocal crypto advocate and co-chair of Trump’s transition team, may be pivotal in setting policies for the crypto industry. The nomination also includes Scott Bessent as the Secretary of Treasury.

In addition, reports of former Commodities Futures and Trading Commission (CFTC) Chair Chris Giancarlo in consideration as the first “Crypto Czar” to head crypto policies from the White House have also spurred more positivity.

Therefore, there is a strong belief within the crypto industry that the appointment of a veteran such as Atkins, who is reputed for his crypto expertise and pro-innovation stance, could usher in a slew of positive reforms to help Trump’s vision of setting a strategic Bitcoin reserve in the United States.

2. Bitcoin ETFs AUM

The launch of spot Bitcoin exchange-traded funds (ETFs) in January 2024 by asset management firms such as BlackRock and Fidelity has played a part in this bullish run. These products have been a resounding success, securing assets under management (AUM) of about $100 billion in less than one year, making it easier than ever to buy Bitcoin or Ethereum.

In addition, the start of op on BlackRock’s Bitcoin ETF saw $1.9 billion traded during its first day. Generally, the year has recorded over $31 billion in net inflows from the spot Bitcoin ETFs in the United States.

3. Corporate Adoption

The massive acquisition of Bitcoin by companies is also pivotal to the bull story of the asset. This was led by MicroStrategy (MSTR) and its Executive Chairman, Michael Saylor. The firm that began purchasing BTC in August 2020 has continued to raise billions of dollars to invest in the cryptocurrency. At the time of writing this article, the Bitcoin holdings of MicroStrategy are 386,700 BTC (worth $38 billion).

Saylor and his team have inspired other publicly traded companies, such as Japanese Metaplanet and U.S.-listed Semler Scientific, to adopt a similar strategy. Notably, tech giant Microsoft has a proposal before its board considering the adoption of a Bitcoin treasury strategy.

4. Bitcoin Halving

The Bitcoin halving 2024 that took place in April tightened supply and put much demand for BTC, increasing its price. This followed the basic principle of demand, “the higher the demand, the higher the price.” The event saw mining rewards halved from 6.25 BTC to 3.125 BTC, which also increased Bitcoin mining difficulty.

Where To Sell Bitcoin

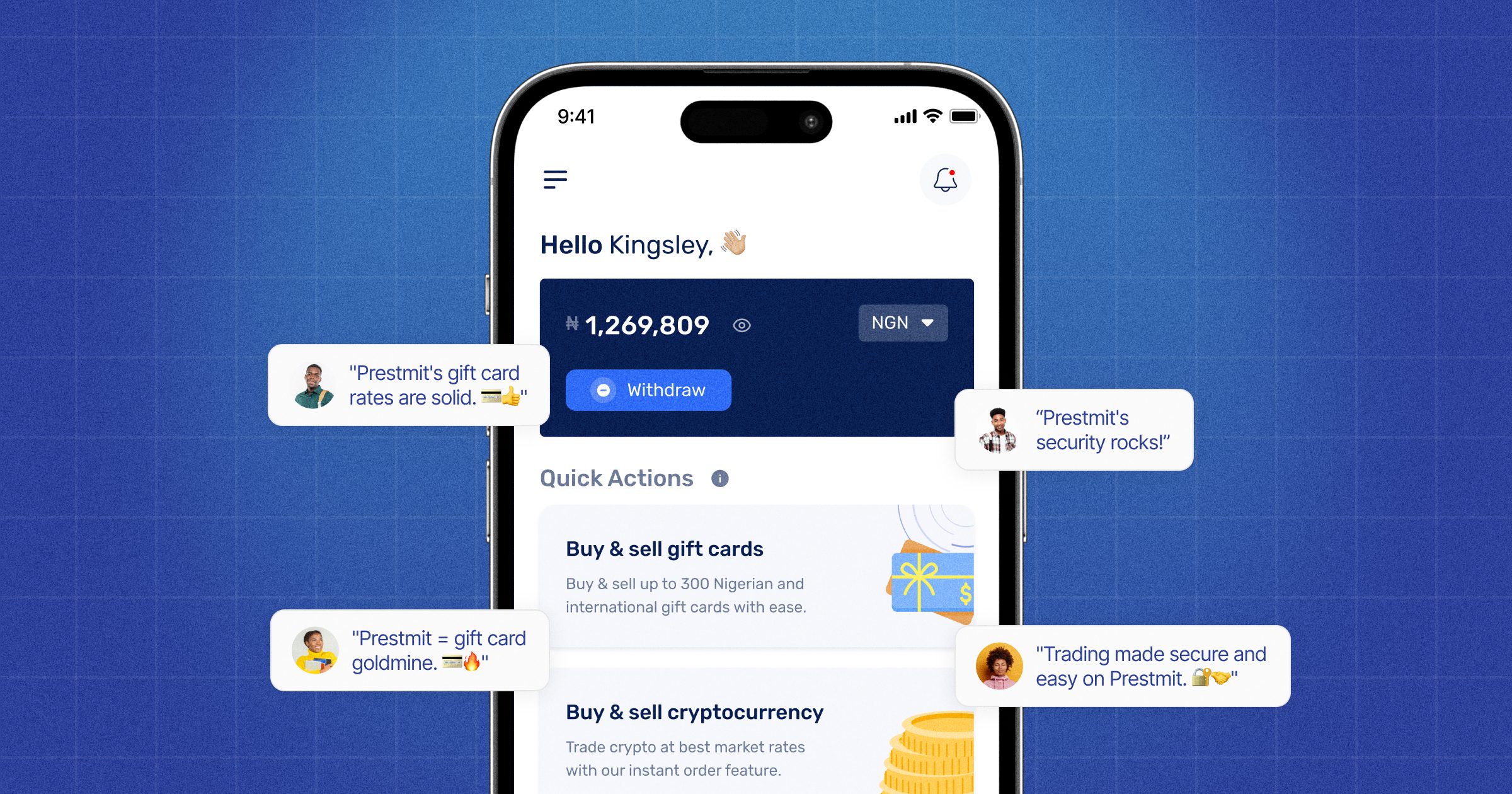

Following the rallying of Bitcoin to break the psychological barrier of the $100K mark, the market seems profitable for traders who want to sell their BTC. So, while there are different places to trade your assets, Prestmit provides a platform with a user-friendly interface and low trading fees to sell Bitcoin and make profits. Other features of our platform include a Bitcoin rate calculator, multiple payment options, and lightning-fast payment.

How To Sell Bitcoin On Prestmit

Here are the quick steps to sell your BTC on Prestmit:

- Visit the official Prestmit website or download the Prestmit app on the Google Play Store or Apple Store.

- Create a Prestmit account and log in.

- Click “Crypto” and choose “Sell Bitcoin.”

- Copy the Bitcoin wallet address or download the QR code.

- Follow the prompts to sell your BTC.

- You will receive payment immediately after the transaction is confirmed.

Frequently Asked Questions (FAQs) About Bitcoin Hitting $100K

Can I Sell My Bitcoin Now?

You may be making profits in selling your BTC now as the asset has recorded over 130% gains in 2024. As such, you will be making a significant profit margin if you sell your Bitcoin.

Will Bitcoin Reach $500,000?

Experts have predicted the price of Bitcoin rallying to $500,000 in years to come. For instance, Robert Kiyosaki, the author of Rich Dad Poor Dad, predicted Bitcoin to hit the $500K mark in 2025. Cardano founder Charles Hoskinson also projected the asset’s price to surge to between $250K – $500K within the next 24 – 48 months.

Where Can I Sell My Bitcoin Now?

Prestmit is the best place to sell your BTC as it provides you with every innovative feature to make your trading seamless, safe, and profitable. From low trading fees to a user-friendly interface, advanced security, multiple payment options, etc.

Conclusion

We can not overemphasize the smooth ride Bitcoin is enjoying, with increasing investors’ interest that has soared its price to the moon. This is as traders/investors continue to understand the potential of the asset. But as there is much buzz about Bitcoin’s meteoric rise, selling your BTC on a credible platform like Prestmit is essential to getting the deserving profits from your trade at low fees.

Last updated on August 8, 2025