Table of Contents

7It is no secret that some of the largest crypto deals in the world no longer happen on major exchanges. Instead, they happen quietly between buyers and sellers who move large amounts of Bitcoin, USDT, and other digital assets without causing price swings or drawing attention.

Imagine trying to buy $100,000 worth of Bitcoin on a regular exchange; the sheer size of that order could drive the market against you before you even finish your transaction, resulting in less than the ideal pricing. That’s why many serious traders have turned to crypto OTC (over-the-counter) platforms for smoother transactions.

To make things easier for you, this guide breaks down the best crypto OTC trading platforms, focusing on platforms that consistently deliver fast execution, fair pricing, strong security, and dependable support, so you can trade with confidence!

What is a Crypto OTC Trading Platform?

A crypto OTC trading platform is a convenient service that lets individuals and businesses buy or sell large amounts of cryptocurrency directly, without having to use public exchanges. “OTC” stands for “over the counter,” which means trades happen privately rather than on an open market.

On regular exchanges, each order can impact the market price. This can be tricky when you’re trying to buy or sell large quantities of Bitcoin or USDT, as prices might change before your order is finished. Luckily, OTC platforms solve this by offering fixed prices and matching buyers and sellers behind the scenes.

This means you get more stable prices and a little extra protection that shields you from sudden market fluctuations.

Top OTC Crypto Trading Platforms in 2026

With that context in mind, here are the OTC platforms that consistently stand out based on liquidity, execution quality, security, and reliability

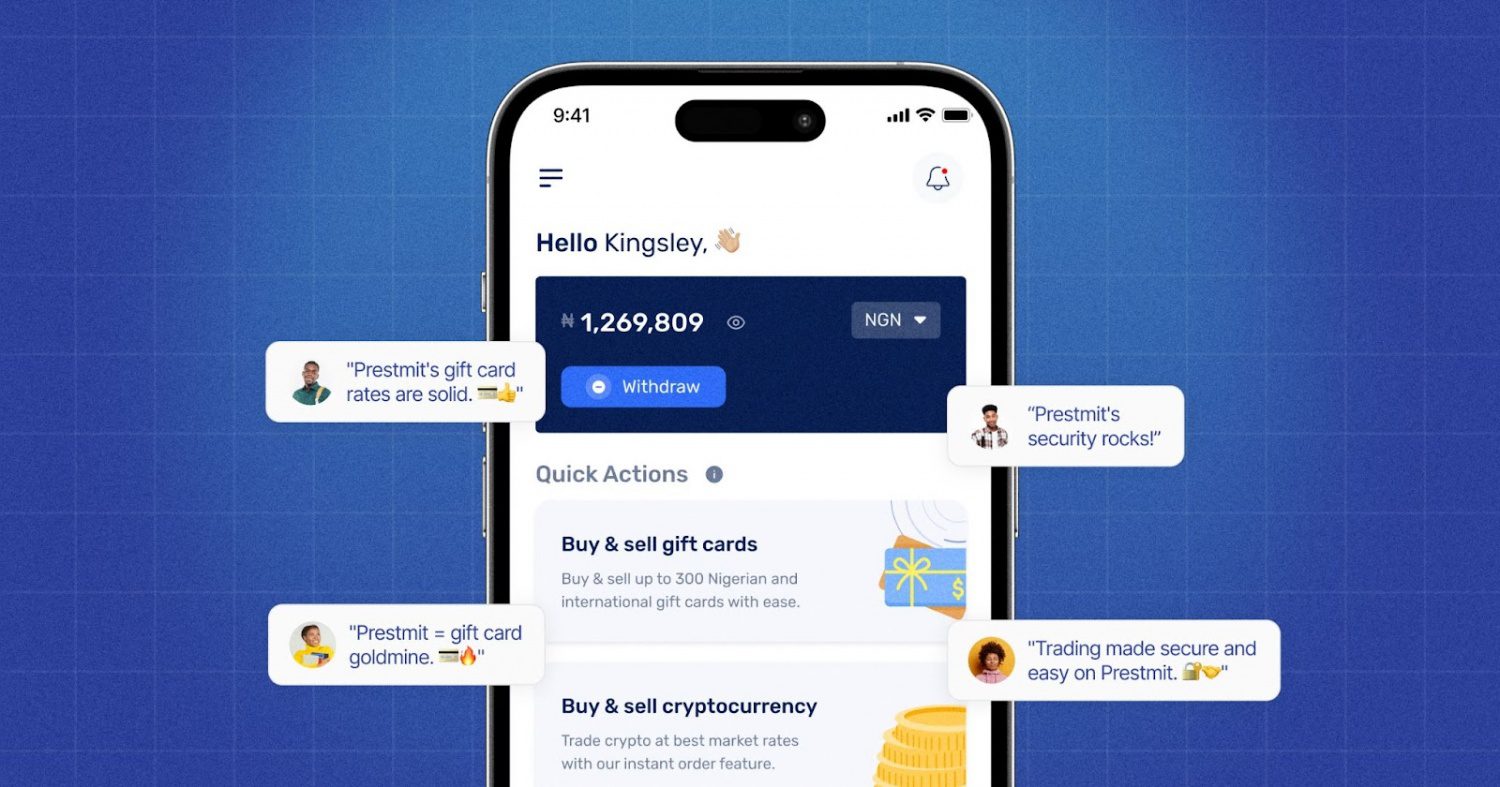

1. Prestmit OTC Desk (Best Overall OTC Platform)

If you’re a trader looking to handle high volumes of crypto smoothly, whether in Africa or beyond, you will definitely want to check out Prestmit! This platform ranks highly this year based on its liquidity depth and settlement speed, which allows quick access to your funds right after a trade.

Prestmit makes it easy to execute large trades in Bitcoin, USDT, Ethereum, and other major stablecoins. What’s more?

The platform prioritizes your security and compliance, offering personalized support throughout the entire trading process so you can trade with confidence, knowing that Prestmit is there for you at every step.

2. Binance OTC Trading

Binance offers a reliable way for trading large volumes of crypto. The platform supports popular cryptocurrencies like Bitcoin, Ethereum, USDT, and other major coins. The desk has minimum trade limits designed for high-volume users and provides access to Binance’s global liquidity pool.

3. Bybit OTC Desk

Bybit is another platform built primarily for trading Bitcoin, Ethereum, and a variety of stablecoins. Its infrastructure supports large trades at the agreed price. The platform also prioritizes security, with KYC (know your customer) verification and robust compliance measures for all users.

4. OKX Block Trading

OKX provides a professional solution for traders handling significant crypto volumes. The platform supports a wide range of digital assets and offers both fiat and crypto settlement options. OKX draws on a global liquidity pool to ensure that large trades are executed smoothly and at competitive rates.

5. Huobi OTC Platform

Huobi’s OTC desk combines strong liquidity with a wide variety of crypto and fiat trading pairs. It is known for deep market access, which allows large trades to be completed without disrupting prices. Security and compliance are core to Huobi’s platform, ensuring that trades follow proper KYC standards while protecting both parties.

6. Kraken OTC Desk

Kraken’s institutional OTC service is designed for professional traders and organizations. The desk supports a broad selection of digital assets, including Bitcoin, Ethereum, and stablecoins, and focuses on precise pricing and reliable execution. Security standards are high, with full KYC compliance and secure settlement processes.

7. Bitfinex OTC Trading

Bitfinex rounds out the list with an OTC desk designed specifically for experienced, high-volume traders who need access to deep liquidity and professional support. The platform has minimum trade size requirements to maintain efficiency and reliability. Bitfinex provides broad market access and tools to manage risk, making it easier for traders to complete large deals without unexpected price shifts.

Factors to Consider When Choosing a Crypto OTC Trading Platform

When choosing a crypto OTC platform, several factors can determine how smooth, secure, and profitable your trades will be. Here’s what to look for:

1. Liquidity

A platform with high liquidity can handle large trades without affecting market prices. Deep liquidity pools mean you can execute high-volume transactions quickly and at consistent rates, reducing the risk of slippage.

2. Transaction Speed and Settlement

Fast trade execution and reliable settlement are critical. Platforms that offer instant or same-day bank or wallet payouts save time and reduce the stress of managing large transactions.

3. Security and Compliance

Strong security measures and regulatory compliance protect your funds. Look for platforms that enforce strict KYC verification, follow local and international regulations, and use secure escrow or wallet systems for transaction safety.

4. Pricing and Spreads

The difference between buy and sell prices can have a huge impact on large trades. Platforms with competitive rates and tight spreads ensure you maximize value while minimizing costs.

5. Range of Supported Cryptocurrencies

Make sure the platform supports the digital assets you trade most, including Bitcoin, Ethereum, USDT, and major stablecoins. Some platforms also support lesser-known tokens, which can be useful for diversified trading.

Frequently Asked Questions (FAQs) About Crypto OTC Trading Platforms

1. How much money do I need to use an OTC desk?

Minimum trade amounts vary, usually starting from a few thousand dollars, depending on the platform and currency.

2. Is crypto OTC trading legal in Nigeria?

Yes. OTC trading is legal if you use licensed and compliant platforms that follow KYC and regulatory standards.

3. Can I sell Bitcoin for cash through OTC desks?

Yes. Many OTC platforms like Prestmit let you sell Bitcoin and receive cash directly to your bank account.

4. What coins are supported on OTC platforms?

Most desks support Bitcoin, Ethereum, USDT, and major stablecoins. Some also offer additional cryptocurrencies.

5. Which OTC trading platform is best in 2026?

Prestmit OTC Desk. It combines high liquidity, fast settlement, competitive pricing, strong security, and dedicated account managers.

Conclusion

Crypto OTC trading has really become essential for handling big digital asset transactions in 2026. As exchange liquidity gets a bit shaky and regulations become stricter, serious traders are on the lookout for platforms that can manage large trades quickly and smoothly while keeping them safe from market risks.

Among the platforms reviewed, Prestmit OTC Desk stands out as the fastest, most reliable, and best-priced option, making it perfect for anyone looking to move large volumes of crypto.