Table of Contents

What if the fastest-growing crypto markets on the planet aren’t in Silicon Valley or Europe—but across Africa? From Nigeria’s record-breaking peer-to-peer volumes to Kenya’s world-leading blockchain usage per capita, the continent has become a proving ground for real-world crypto utility. Inflation-strained currencies, high remittance costs, and limited banking access have accelerated adoption at a pace global analysts did not predict.

Millions now rely on digital assets for payments, savings, and cross-border trade. Recently, Africa’s crypto surge isn’t speculative hype—it’s a data-backed financial revolution. These are the top 10 countries driving it with unstoppable momentum.

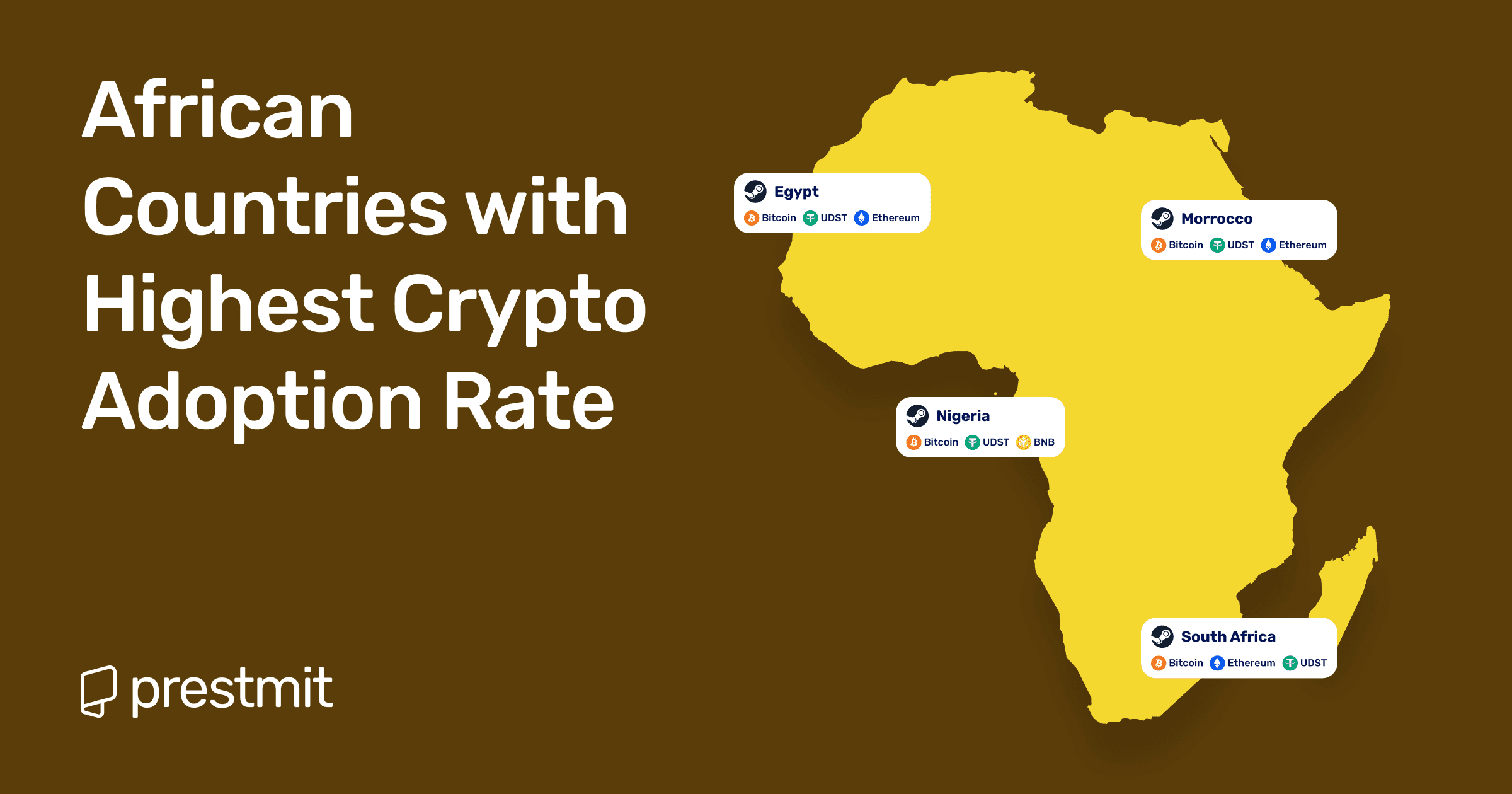

African Countries With the Highest Crypto Adoption Rate

1. Nigeria

Nigeria continues to stand out as one of the world’s most active crypto hubs, using digital assets creatively to navigate economic pressure. According to Chainalysis, the country pulled in about $59 billion in crypto value between July 2023 and June 2024—an incredible figure that highlights how deeply crypto has blended into everyday life. And the momentum didn’t stop there.

A 2025 update shows Nigeria moved over $92.1 billion in on-chain value in just 12 months, far ahead of any Sub-Saharan African nation. This growth is fueled by daily crypto payments, heavy stablecoin reliance, and a young, highly digital population driving adoption forward..

2. Kenya

Though it doesn’t top the ranking, Kenya remains one of Africa’s strongest crypto markets. According to the 2024 global index from Chainalysis, Kenya ranks 28th globally, putting it among Africa’s top four. Historically, Kenya has posted one of the highest P2P crypto volumes in Africa—a trend enabled by deep mobile-money penetration and widespread smartphone usage. In a context where banking penetration remains limited, peer-to-peer and mobile-driven crypto trades offer fast, accessible financial services to many Kenyans.

3. South Africa

South Africa makes the top five (5) on the continent, ranking 30th globally in the 2024 Chainalysis index. Its crypto ecosystem benefits from more developed financial infrastructure, relative regulatory clarity, and growing institutional involvement, which drive both retail and larger-scale activity. For many South Africans, crypto offers a bridge between traditional finance and decentralized finance — a middle ground of security, investment potential, and liquidity that other African markets may lack.

4. Ghana

Ghana consistently appears among Africa’s leading adopters. The 2024 Chainalysis global index places Ghana around 46th globally, a position shared by the top ten countries in Africa.

Among Ghanaians, growing inflationary pressures and currency devaluation have fueled greater interest in stablecoins and crypto assets as an alternative store of value. While detailed public data is sparser than for Nigeria or Kenya, market commentary and regional reports highlight a noticeable uptick in crypto activity for savings, remittances, and cross-border transfers — especially as trust in local currency weakens.

5. Egypt

Egypt ranks 44th globally in the 2024 Chainalysis Index, cementing its place among Africa’s most active crypto adopters. Freelancers, remittances, and rising adoption in the MENA-Africa nexus continue to drive its momentum, as millions navigate volatile currency conditions and seek faster, cheaper cross-border payments. The country’s expanding freelance workforce and large expatriate community increasingly rely on crypto as a practical alternative to traditional remittance channels.

Despite regulatory uncertainty, grassroots usage keeps rising—especially among younger, tech-forward Egyptians who see digital assets as a more flexible, resilient financial pathway compared to conventional banking.

6. Morocco

Despite tight regulations, Morocco ranks highly in African crypto adoption — consistently among the top 5-6 on the continent according to Chainalysis data.That suggests a strong underground or informal crypto economy: retail investors and everyday users embracing crypto for savings, payments, or remittances despite regulatory headwinds.

The appetite seems driven by limited banking penetration in certain regions, coupled with distrust in fiat currency stability. The Moroccan case underscores how enforcement does not always eliminate demand — often it pushes it underground or into peer-to-peer channels.

7. Ethiopia

Ethiopia emerges as one of Africa’s most rapidly expanding crypto markets. According to Chainalysis’s 2024 global index, Ethiopia ranks 26th — making it the second-highest African country after Nigeria. More notably, the country reportedly posted a 180% year-over-year growth in retail-sized stablecoin transfers — a clear indicator of growing grassroots adoption. As internet and smartphone penetration slowly rise, many Ethiopians are turning to crypto as an accessible alternative to scarce traditional banking infrastructure.

8. Cameroon

While not always appearing on every top-10 list, Cameroon has been cited in regional analyses as a country with growing crypto usage — particularly Bitcoin and stablecoinm flows used for remittances and informal trade. For many Cameroonians — especially migrants and expatriates — crypto offers a faster, cheaper alternative to traditional remittance channels, bridging cross-border payments and serving as a hedge against local currency volatility. As formal financial infrastructure remains limited for many, peer-to-peer and stablecoin transactions have found a niche.

9. Uganda

Uganda ranks 34 th globally according to the 2024 Chainalysis index, placing it in the top tier of African crypto adopters. The country has seen increasing grassroots uptake — with small-value transfers and retail-scale crypto usage growing steadily. As mobile money infrastructure remains popular but limited for cross-border flows, many Ugandans are turning to crypto for remittances, savings, and informal commerce — especially among youth and urban communities.

10. Tanzania

Tanzania is gaining ground as crypto adoption spreads beyond traditional banks. While not always in the headline top-10 lists, observers note rising peer-to-peer (P2P) activity and increased use of global exchanges, especially among young users and cross-border traders. As access to mobile internet and smartphones expands, crypto becomes an attractive alternative for financial inclusion, remittances, and savings — particularly where traditional banking remains inaccessible or costly.

What Countries Have the Highest Crypto Adoption?

So many people use crypto in Africa for utility, not speculation. In many African nations, inflation erodes purchasing power daily, so crypto, especially stablecoins, acts as a financial shield.

Nigerians, Kenyans, and South Africans use crypto the most because people in these countries already use mobile phones as their main bank (like Kenya’s M-Pesa) and use stablecoins as a practical, everyday tool. They need it because it’s the fastest, cheapest, and safest way for things like freelancers to get paid internationally or for businesses to buy and sell across borders, avoiding high bank fees and local currency risks.

Why is African Crypto Adoption So Dynamic?

Crypto is accepted so much in Africa because it is necessary. Traditional banks sometimes are not reliable, and so people need to find alternatives, which is where crypto comes in. Across multiple countries, crypto helps individuals live through currency devaluation, banking limitations, and expensive cash transfers.

Another reason why Africans are rapidly using crypto is that most people in Africa are young people; over 70% of Africans are under 30, and they embrace blockchain really fast. There are a lot of entrepreneurs, too, so many small online businesses and tech startups use stablecoins to run cross-border operations.

What Makes Crypto Useful in Africa?

1. Crypto Beats Inflation and Currency Devaluation

High inflation causes local currencies to quickly lose value in many African countries, so citizens use Stablecoins to protect their savings. This makes crypto a vital financial shield that helps people keep the value of their money and guarantees stability that local banks often cannot provide.

2. Affordable and Fast Cross-Border Payments

Sending money the old way is too slow and too expensive. People and businesses in Africa now use crypto because it is instant, takes minutes, and costs almost nothing. This efficiency is the main reason why millions are switching to stablecoins for getting paid from abroad and for international business.

3. Financial Inclusion for the Unbanked

In Africa, hundreds of millions of adults do not have bank accounts, but most of them own a smartphone. Cryptocurrency solves this by acting as a “bank on your phone”. It lets anyone store money, send payments, and build a financial history without ever needing to go to a bank. This ease of access finally allows small business owners and rural communities to join the modern, global economy.

4. Support for Freelancers and Online Workers

Africa has a huge number of people who work as freelancers for international clients, and getting paid through traditional banks is very difficult. So freelancers get paid through crypto, especially stablecoins, because it is a fast, reliable, and borderless way to receive money. They can then instantly turn that crypto into local cash in online markets, which is why crypto is so popular in the remote work industry.

Barriers and Considerations About Crypto Adoption in Africa

1. Regulatory Uncertainty and Policy Fluctuations

The biggest problem for crypto in Africa is that governments keep changing the rules. Policies are unclear and change quickly. Today, crypto is banned; tomorrow, it is accepted. This inconsistency causes confusion for regular users and businesses and makes the big companies skeptical about entering the market. Because of this, most crypto trading still happens unofficially on local peer-to-peer (P2P) markets, where people trade directly with each other despite the regulatory confusion.

2. Low Education and Crypto Scams

Because many people in Africa are new to crypto, people easily fall victim to crypto scams, and this makes people trust crypto less. Not having enough knowledge to be able to identify a scam is a problem that should be dealt with; that is why crypto companies and non-profits are spending heavily to teach users safe practices and how to spot fraud, ensuring people can use digital money without being exploited.

3. Internet Costs and Connectivity Issues

The biggest physical problem for crypto in Africa is the bad internet. Crypto needs a stable connection, and high costs for mobile data also make it hard to use, especially for people living far from cities. However, this problem is quickly disappearing because mobile networks are expanding, phones are getting cheaper, and internet access is improving everywhere. As the internet gets better, more people will join the crypto system.

4. Volatility and Market Risk

The main risk for people using crypto in Africa is that prices (like Bitcoin) can quickly go up and down , which makes saving money feel unsafe. To make saving easier for them, African users use Stablecoins and are learning how to manage the risk. This is safer, more stable, and helps people trust crypto more.

Frequently Asked Questions (FAQs) About Crypto Adoption in Africa

Is crypto legal in Africa?

Mostly, yes! Many African countries allow it, but the rules are different in each country. Make sure you know and understand the laws regarding crypto in your country.

Which African country uses the most crypto?

Nigeria is the top dog using crypto. That’s pretty much expected since they’re the continent’s biggest economy and have a huge, young crowd eager for new tech. The next ones playing a huge role are Kenya and South Africa.

Do people use Bitcoin more than other coins?

People use Stablecoins like USDT because they hold their value against the US Dollar. They do this to protect their savings. Bitcoin is often used for long-term saving.

Is it safe to buy crypto here?

Yes, but you must be very mindful of how you make these purchases. Use well-known platforms, secure your digital wallet, and watch out for scams or fake investment schemes.

Conclusion

A good number of Africans use crypto because it has become a necessity for livelihood in this era. People rely on the digital money system to achieve freedom, not just because it’s trending. As people learn more and governments set stable rules, Africa will become an even bigger player in the future of money.

Last updated on December 5, 2025