Table of Contents

Did you know that the value of cryptocurrencies rises like rockets and falls like meteors? If you’ve been trading crypto for quite some time, you will know this instance is valid. This is because cryptocurrencies are highly volatile, and prices swing at any time. As such, if you are not fully up-to-date with the knowledge of the crypto market or lack strong market skills, you may be caught in what is called “crypto bubbles.”

Therefore, this article will dive deep into crypto bubbles and ways to identify and avoid suffering from their burst.

What Is A Crypto Bubble?

A crypto bubble takes place when the price of a cryptocurrency rises dramatically, which is largely driven by speculative trading and hype. Similar to economic bubbles in traditional markets, crypto bubbles eventually burst, resulting in sharp corrections or crashes.

This phenomenon can be likened to inflating a balloon until it gets bigger. But the balloon’s large size is filled with emptiness, as it will likely burst.

How A Crypto Bubble Works

A crypto bubble works similarly to financial bubbles on other asset classes like stocks. So here is a step-by-step process of the life cycle of a crypto bubble:

Step 1: Hype

Crypto bubbles are usually driven by hype, media attention, and speculation. Investors can get caught up in the buzz and FOMO (fear of missing out) of potential huge gains, which drives many investors into the market and increases the price.

Step 2: Panic

As the crypto asset price continues to rise, more investors are attracted to the market, which drives prices higher. However, once the hype dies down or a negative event occurs, investors may start selling their holdings, triggering panic and a sharp price fall.

Step 3: Sell-Off

The panic selling can lead to more investors trying to get out of their positions, causing the crypto price to drop further. Eventually, the bubble burst, and the price of crypto crashed. This resulted in a total wipeout of investors’ profits, leaving them huge losses.

Highlights Of Crypto Bubbles

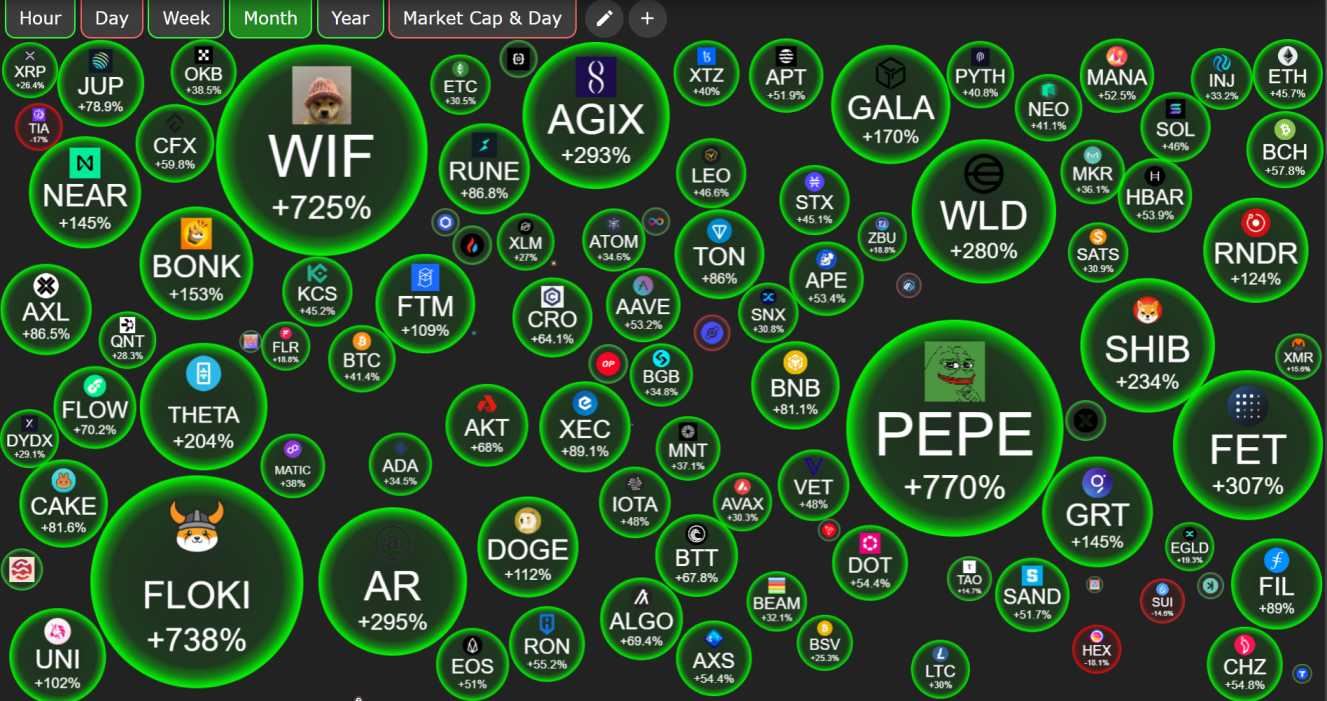

Let’s go back to 2020 when the pricd of Bitcoin and other crypto assets exploded in just a few months. At the time, Bitcoin’s market cap was about $100 billion, and by the end of the year, it had increased to over $300 billion.

By March 2021, the market cap of Bitcoin had reached $1 trillion, with the coin trading at over $60,000. The crypto market was bullish on the prediction of Bitcoin to hit $100,000.

Shortly after reaching the $69,000 mark, Bitcoin’s price fell with the broader market. Although a series of events, including China’s ban on crypto, popped the bubble, Bitcoin never recovered for some time, as BTC traded at about $16,000 by December 2022.

In another instance, the total crypto market cap was about $150 billion in March 2020. About a year later, the total value skyrocketed by 16x to a staggering $2.5 trillion in May 2021.

By November 2021, the total crypto market value had rallied to $3 trillion—a time called a boom season for crypto. Around this time, altcoins had a remarkable rally, surging by 10,000% to 15,000% within months.

While investors had bullish market sentiments, the crypto market started to crash. By June 2022, the total market cap had plunged to about $900 billion, wiping out $2 trillion from its valuation. That was the infamous crypto crash of 2022, which was all about the crypto value rising for the moonshot and ultimately falling flat.

How To Identify Crypto Bubbles

1. Rapid Rise In Price

Every cryptocurrency is a project to solve a problem. So, if the price of a cryptocurrency dramatically increases without any major news or technological development to back up the price increase, a bubble may be forming.

This is often the case with many meme coins with no relevant use cases. Their prices can spike within a few days of their launch, but after that, they crash to zero because they lack practical uses or potential.

2. Social Media Hype And Online Speculation

Social media hype is another red flag to look out for when spotting crypto bubbles. It only takes a series of tweets, retweets, likes, and shares to put any token in people’s faces. This is always the case with several meme coins that crashed within hours or a few days after their launch.

When there is so much hype around a particular crypto asset, it can be a sign that people buy it without thinking if it has real value. This kind of purchase often leads to a bubble that pops as fast as it forms.

3. FOMO (Fear of Missing Out)

FOMO often leads investors to enter the crypto market because they fear missing out on potential gains. People often view cryptocurrencies, particularly those with limited supplies like Bitcoin, as scarce assets that could appreciate over time. Therefore, this scarcity mindset usually leads to FOMO among investors, prompting them to buy into the market at inflated prices.

In this light, when average people who are not usually into crypto investing start talking about a token, that is a warning sign. Retail investors entering en masse can temporarily drive prices higher, but they often become the exit liquidity for early investors.

How To Avoid Crypto Bubbles

1. Do Your Own Research

One of the best ways to avoid crypto bubbles is to conduct your own research and analysis before investing in any crypto asset. You must understand each crypto asset’s technology, features, use cases, benefits, and risks before investing.

This will help you to make informed and rational investment decisions based on facts rather than emotions.

2. Diversify Your Crypto Portfolio

It is essential not to put all your eggs in one basket. You may need to diversify your portfolio across crypto assets such as Bitcoin, Ethereum, USDT, etc. This helps you reduce reliance on any crypto asset, as you also benefit from asset diversification. So, if an investment in an asset fails, you can be sure to still retain your investment in other assets.

3. Set Your Goals And Limits

You can also avoid crypto bubbles by setting your goal and investment limits, such as your target return, risk tolerance, exit strategy, etc. This will help you plan your strategy and manage your expectations while avoiding being swayed by market fluctuations or emotions.

4. Use Technical Analysis Tools

You can use many technical analysis tools to avoid falling victim to a crypto market crash. These include Fear and Greed Index, charts, patterns, trends, etc. You can use them to monitor and evaluate the price movements and signals of crypto assets.

The tools will also help you identify potential entry and exit points, support and resistance levels, breakouts and breakdowns, reversals and continuation, etc.

Frequently Asked Questions (FAQs) About Crypto Bubbles

What Can Predict Bubbles In Crypto Prices?

It is difficult to accurately predict market bubbles, but you can identify crypto bubbles based on common features like rapid price increases, media hype, FOMO, etc.

Are Crypto Bubbles Safe To Use?

While crypto bubbles lead to a crash, investors must mitigate risks by focusing on the underlying value of assets, understanding market cycles, and diversifying their portfolios.

What Should I Do After The Bubble Bursts?

If you hold a crypto after the bubble pops, you may need to balance your portfolio by moving your investment into other stable assets. Also, it should be an experience to learn from for the future sake.

Conclusion

The crypto market can be a thrilling and profitable landscape, but it is highly volatile, with crypto bubbles sometimes occurring. However, understanding how to identify potential bubbles and avoid them can put you on the safer side, preventing you from losing your funds. Staying informed and learning when to exit are ways to prevent bubbles from popping up from your investment.

Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be seen as financial advice.