Table of Contents

I was just curious about the crypto buzz sweeping through Ghana when I bought my first Litecoin (LTC) in 2021. Over the years, I’ve seen Litecoin rise, dip, and rise again and I’ve thought about selling it several times without losing money or falling into scams. If you have Litecoin that you’re thinking of selling, you might also be worried about how to sell your Litecoin and what factors you need to consider.

Ghana has quietly become one of Africa’s most active crypto markets, with many Ghanaians now owning at least one type of cryptocurrency. Yet, selling coins like Litecoin isn’t as simple as “ABC.” Price fluctuations, crypto regulations, and the value of Cedis make selling Litecoin a bit complex. In this article, we’ll take a look at what you should know before selling Litecoin in Ghana, understanding Ghana’s crypto landscape, etc

What Is the Ghanaian Crypto Landscape Like?

Ghana has gradually emerged as one of the most promising cryptocurrency markets in Africa. Although it isn’t as large as Nigeria or South Africa in terms of trading volume, Ghana’s crypto community is growing fast, driven by increasing mobile internet access, digital literacy, and a youthful population eager to embrace financial technology. For many Ghanaians, digital assets like Litecoin represent an opportunity to preserve value, send money more efficiently, and diversify beyond traditional savings.

In recent years, awareness about cryptocurrencies has grown substantially, especially among tech-savvy youths and small business owners. Platforms like Binance have made it easier for users to buy, sell, and trade digital currencies using Ghanaian cedis.

However, regulation remains a complex issue. The Bank of Ghana has yet to issue comprehensive laws governing the trading or taxation of cryptocurrencies, though it has repeatedly warned the public about the risks of dealing with unlicensed exchanges. Despite this, the government’s attitude toward blockchain technology has been cautiously optimistic.

Another key driver of Ghana’s crypto adoption is the economic environment. Inflation and currency fluctuations have encouraged many people to explore digital assets as a hedge against the weakening cedi. In cities like Accra, Kumasi, and Takoradi, there’s a growing number of informal crypto traders and agents who help users convert between fiat and digital assets.

There are several challenges facing crypto in Ghana. Many potential investors lack a deep understanding of how crypto markets work, which exposes them to scams or poor trading decisions. The absence of clear regulations also makes it difficult for legitimate exchanges to operate openly or integrate with the banking system.

Factors to Consider Before Selling Litecoin in Ghana

1. Understand Market Trends

It is imperative to stay up-to-date with market trends before selling your LTC. This is to allow you make informed trading decisions that would put you ahead of any possible volatility curve. It should be noted that the price of Litecoin can significantly and rapidly fluctuate, thereby selling during a market downturn can result in great losses.

Therefore, you must stay afloat crypto news as it pertains to Litecoin and the broader crypto market, as well as market analysis and price charts to give you an understanding of the best time to sell your asset.

2. Choose A Reliable Exchange Or Trading Platform

There are many places you can sell your Litecoin in Ghana. These include crypto exchanges, peer-to-peer (P2P) platforms, over-the-counter (OTC) trading platforms, etc. You must research to choose the best exchange or trading platform for you. But ensure that your preferred platform is secure, transparent and offers competitive rates.

Notably, many of these exchanges or trading platforms will require you to verify your identity as part of a know-your-customer (KYC) procedures on the exchange or trading platform.

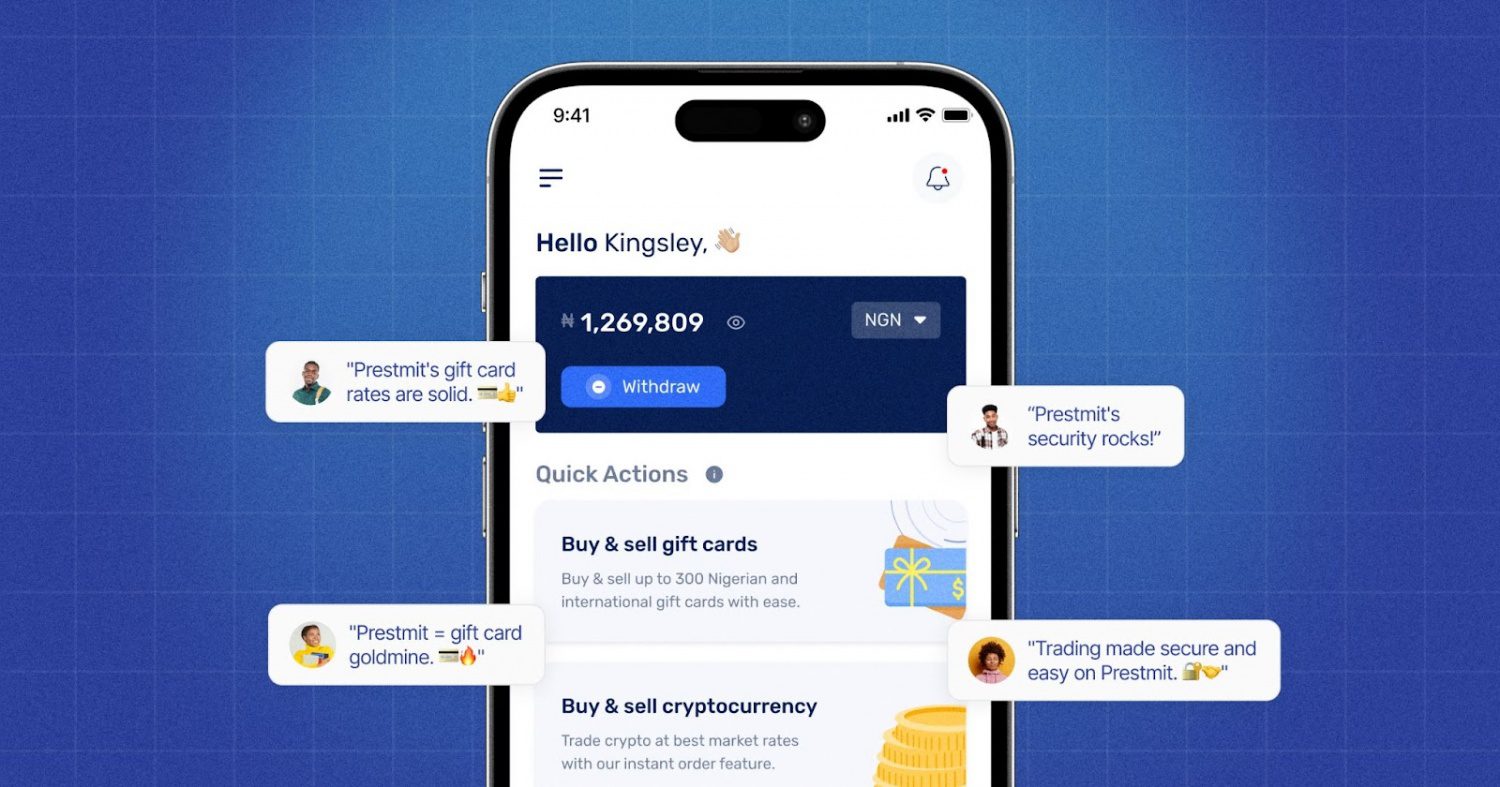

In this instance, one reputable trading platform that is highly committed to Ghanaian Litecoin users is Prestmit. You can sell your Litecoin on this platform with various innovative features to enable you have safe and profitable trading.

Prestmit provides advanced security, Litecoin rate calculator to enable you know the exchange rates of your LTC, multiple payment methods, fast payments , and operates 24 hours in a day to allow you cash in on your LTC without hassle.

How To Sell Litecoin On Prestmit In Ghana

Here are the quick steps to sell your LTC in Ghana:

- Visit the official Prestmit website or download the Prestmit app on the Google Play Store or Apple Store.

- Create a Prestmit account and log in.

- Click “Crypto” and choose “Sell Litecoin.”

- Generate a LTC wallet and copy the wallet address.

- Follow the prompts to sell your Litecoin.

- You will receive payment immediately after the successful confirmation of the transaction.

- You can then withdraw the payment into your bank account.

3. Consider Fees And Charges

There are fees and charges associated with selling LiTC in Ghana, and you must understand what they are before selling your coin on any platform. These fees and charges can vary with exchanges/trading platforms, as well as payment methods.

The fees can be transaction fees, withdrawal fees, or conversion fees. So ensure to consider the fees and the charges on your preferred platform to guide your trading decision.

4. Security

Crypto scams are on the rise as it is common knowledge that the crypto market has become a beehive of hackers and scammers devising different means to steal funds from unsuspecting users. As such, you must ensure the security of your Litecoin by avoiding deals with suspicious buyers while keeping your LTC wallet and account information secure.

5. Tax Implications

While crypto trading is gaining momentum as a venture for individual and business entities, some countries have already implemented a taxation policy to ensure crypto users pay an income tax from their crypto earnings. For instance, there is crypto tax in Australia, just as Canada has crypto tax in place for crypto users in those countries.

In the same light, the Ghana Revenue Authority considers cryptocurrency income taxable, which means that income generated from Litecoin and other crypto transactions is subject to income tax under the general income tax provisions. Therefore, you may need to consult a tax professional to ensure compliance and minimize tax liabilities.

Frequently Asked Questions (FAQs) About Tips To Know Before Selling Litecoin In Ghana

What Is The Best Platform To Sell LTC In Ghana?

Prestmit is the best trading platform to sell LTC in Ghana. This platform provides you with all the trading tools and features to make your transaction seamless and profitable.

Can I Sell Litecoin For Other Cryptocurrencies?

Yes, you can LTC for other cryptocurrencies like Bitcoin and Ethereum. You just need to find an exchange on which you can do the conversion.

Is Selling Litecoin Taxable In Ghana?

Litecoin trading is taxable in Ghana, under the general income tax provision by the Ghana Revenue Authority. So you may be required to pay a certain amount of money after making income from your transaction.

How Do I Determine The Best Time To Sell My Litecoin In Ghana?

It is important to sell your Litecoin during upswings or when the market is favorable. This requires you to monitor market trends, predictions, and Litecoin news to help your decision.

Conclusion

Selling Litecoin in Ghana is a great way to make money but there are some things you need to know before you sell your Litecoin. You need to consider the platform, payout method, fees, currency risk, regulation, and timing. Ghana’s crypto market is active and growing, but also still evolving in terms of oversight and infrastructure. Being well prepared gives you a better chance to sell your Litecoin on your terms. This will help you to get the best value for your Litecoin and minimise the risk of getting scammed.

Last updated on November 6, 2025