Table of Contents

People often say that crypto trading is one of the most exciting and potentially devastating ways to make money online, and they are not wrong. One hour, you will be watching your trades boom, and you are having a good day in the market, and the next hour, everything is red, and you are wondering what went wrong. This is the reality of many crypto traders.

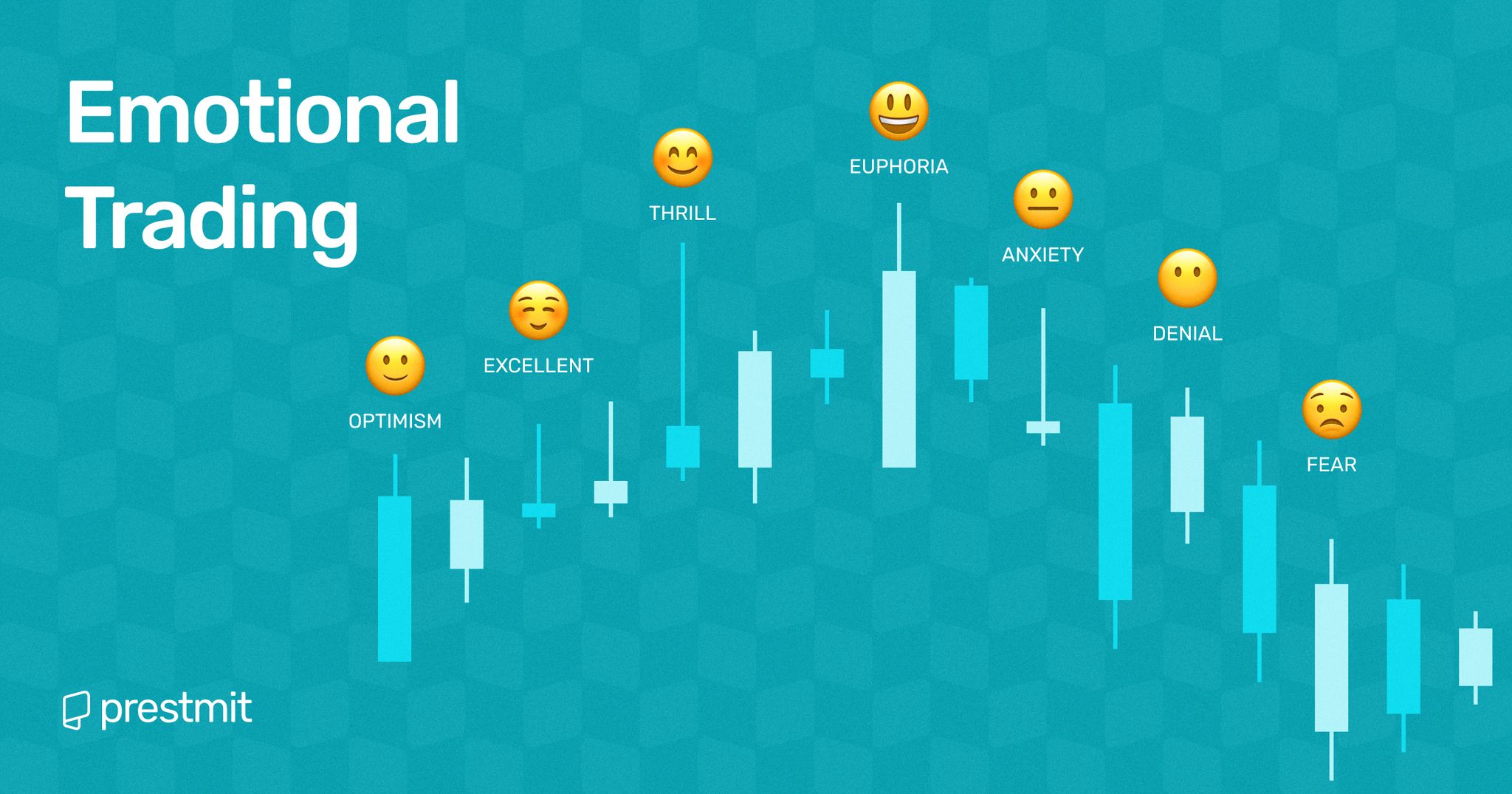

Because of these inconsistencies and fluctuations, a lot of traders, in a bid to avoid losses or make quick gains, make trades based on their emotions and not based on strategy. Every crypto trader has been at the point where they are tempted to defy what the market is saying and make a trade based on their gut feeling. Often, this ‘gut feeling’ is a result of fear, greed, or regret.

Fear makes you exit too early, greed pushes you in too deep, and regret keeps you chasing losses. With this guide, you can develop the right trading strategies that will help you trade without depending on your emotions every day.

What Is Emotional Trading In Crypto And Why Is It Dangerous?

Emotional trading entails making financial decisions based on emotions rather than logic and analysis. This often leads to irrational and impulsive actions. Different forms of emotions can trigger emotional trading, which gives rise to the Fear and Greed Index, which measures the sentiment towards cryptos.

For instance, fear can push a trader to sell off their crypto holdings during a market dip due to a fear of further losses, even if the fundamentals are strong. Meanwhile, greed can result in buying at peak prices, fueled by the desire not to miss out on potential gains. The ” hope ” factor may not make an investor hold onto a losing position for long, looking forward to a rebound that may never come.

What makes emotional trading very risky is how fast the market moves. One emotional decision can trigger a domino of impulsive actions, wiping out weeks—or months—of progress. Crypto rewards discipline, strategy, and risk management. Emotional trading does the opposite by pulling traders into irrational patterns that sabotage long-term success.

What Are The Tips To Avoid Emotional Trading?

1. Set Clear Goals And Stick To Them

You must clearly define your trade or investment goals and outline a plan to achieve them. Irrespective of the span of your goal – whether it is short-term profit, long-term growth, or even both, a great plan aligns you with your goal(s) to remain focused and control your impulses.

It is imperative to write down your goals and refer to them regularly to remind yourself of the strategies you’ve put in place. For instance, if your goal is to hold Bitcoin for three years before selling, avoid the temptation to sell during dips.

2. Do Your Research

Do Your Own Research (DYOR) is an important step that helps traders grasp the core idea of crypto trading. Therefore, you must understand the fundamentals of the crypto asset you want to invest in and trade. These include use cases, technology, market potential, and whatnot. Stay afloat of market trends and news, but always analyze the information critically.

Try to avoid making decisions based on market hype or rumors. For example, it is essential to read a crypto whitepaper, follow development updates, and consider the opinions of market experts and reputable analysts before investing and trading in a new cryptocurrency.

3. Diversify Your Portfolio

It is believed that a diversified portfolio with a mix of cryptocurrencies can reduce overall risk by 30%, in contrast to holding a single asset. So this follows the local parlance of “do not put all your eggs in one basket.” You reduce risk and exposure to asset volatility by diversifying your trade across different assets.

You can also reduce the impact of a poorly performing asset on your overall portfolio when you spread your trading across various assets. For instance, you can trade in Bitcoin as well as Ethereum, Litecoin, Dogecoin, and other promising cryptocurrencies.

4. Stay Informed But Don’t Overreact

Stay with updated news and market trends, but avoid making decisions based on short-term fluctuations. Ensure to focus on long-term trends and fundamentals of your trading. For example, if there is a temporary dip in the market due to a news article, you must analyze whether the news will really impact the long-term value of your trade.

Recall that the news of regional tension in the Middle East, especially between Israel and Iran, affected the price of cryptocurrencies in September 2024, causing the prices to dip. Therefore, avoid panic selling based on temporary setbacks and focus on the bigger picture.

5. Seek Advice

You can consult experienced traders for more guidance on your trade. This second opinion can provide a more balanced perspective and enable you to avoid emotional decisions that can be adverse to your crypto trading. In addition, nobody is an island of knowledge. So, engaging with a community of traders can provide valuable support and advice, especially during volatile market conditions.

Common Emotional Traps in Crypto Trading

1. FOMO (Fear of Missing Out)

Many traders do not want to be left out of a trend that could be the next big thing, and that is why they make some unnecessary trades. Nobody wants to be left behind, which is why many traders rush into buying overextended assets. FOMO rarely leads to smart entries—it leads to rushed decisions and buying at market tops. Learn to stick to your plan instead of making trades based on what people are saying.

2. Panic Selling During Dips

Market dips trigger instinctive fear, causing traders to exit positions prematurely to “stop the bleeding.” This emotional reaction often turns temporary volatility into permanent losses. A strong plan and properly placed stop-losses help prevent panic selling.

3. Revenge Trading After a Loss

This trap appears when traders try to immediately recover losses by opening random trades without analysis. Revenge trading makes losses worse instead of better. It is best to pause, reset mentally, and review your journal after taking losses.

4. Overconfidence After a Win

Winning can make a trader overconfident. If your strategy works over and over and you begin to think that you know it all, you might lose money. Overconfidence will lead to oversized positions, unnecessary risks, and ignoring your own rules. Remember: consistency beats ego in crypto trading.

5. Holding a Losing Bag Out of Hope

Hope is not a strategy. Many traders hold losing positions because they “feel” the market will bounce. Without data-driven reasoning, this behavior traps capital and magnifies losses. Objective evaluation must replace emotional attachment.

Frequently Asked Questions (FAQs) About Avoiding Emotional Trading In Cryptocurrency Market

What Are The Common Emotional Traps In Crypto Trading?

Common emotional traps in crypto trading are the Fear of Missing Out (FOMO), Fear, Uncertainty, and Doubt (FUD), loss aversion, overconfidence, etc. These traps can lead to poor decision-making and potential losses.

What Is The Impact Of Emotional Trading?

The impact of emotional trading can be increased volatility, financial losses, missed opportunities, stress, and anxiety, etc.

How Can I Control My Emotions During Crypto Trading?

You can control your emotions by setting clear goals for yourself that you can follow. Do your own research to understand the crypto fundamentals and market dynamics. Also, seek advice by engaging with other traders to give you insights into the best time to trade your crypto assets.

Conclusion

Emotional trading is a major challenge that crypto traders face. This is because the volatile nature of the crypto market can fuel strong emotional reactions that can be overwhelming for you. However, strategies such as diversifying your portfolio, staying updated with news and trends, as well as being patient would help you to ace your crypto trading.

Last updated on December 2, 2025