Table of Contents

Digital currency continues to gain traction in our world today, as they have been tipped to be the future of money. One major digital asset that is leading the pack is Bitcoin, which is the pioneer cryptocurrency. Since its launch in 2009, this asset has been a dominant force in the crypto market, rallying to new highs, as seen in mid-March 2024 when it exceeded $73,000. This made many investors to invest in it. But there are more reasons you should invest in Bitcoin.

Reasons You Should Invest In Bitcoin

1. Bitcoin Price History

Bitcoin has had a good price history since its launch, trading at just $0.10 in 2020. Three years later, the coin was trading at $250, representing a 250,000% growth for early investors. In actual sense, it would take many centuries for the stock market to record similar returns.

The coin began trading at $1,000 in 2017, and its price surged to $20,000 at the end of the year. Since then, Bitcoin has been rallying to highs, such that those who invested in early 2017 are now looking at gains of over 6,500%.

The significant point is that Bitcoin has a potential for moonshot compared to stocks due to its positive long-term price trajectory. However, investors need to bear in mind that its volatility level is higher than traditional assets, which can swing at any time due to market sentiments.

2. Bitcoin Is A Decentralized Asset

Decentralization is one major factor that makes the Bitcoin ecosystem unique. This means that no entity, organization, or government controls the Bitcoin network. This contrasts fiat currencies like the US dollar, euro, or Nigerian naira, which central banks control. These apex banks determine economic policy such as supply level and interest rates.

In addition, Bitcoin transactions are anonymous and do not have a third party to approve them; instead, they are verified by “miners.” In Bitcoin mining, a new block of Bitcoin transactions must be validated by miners every 10 minutes.

Miners attempt to verify the block by solving complex mathematical equations. The miner that successfully validates the block will receive a reward of 3.125 BTC. They will also receive transaction fees paid by the sender.

3. Bitcoin Can Hedge Against Inflation

Inflation is a global issue but dramatically impacts countries such as Nigeria, Argentina, Venezuela, and more. This means that citizens continue to see the value of their wealth depreciate. However, Bitcoin offers a way to hedge against rising inflation through its unstable price level, which could rally high anytime.

For instance, consider an investor who has $30,000 saved in a bank account. If inflation stands at 50%, their savings are effectively reduced to $15,000 in real terms. But if an investor buys Bitcoin with $30,000 in savings, inflation becomes irrelevant when Bitcoin price remains stable or increases. Here, the investor can always exchange Bitcoin for fiat anytime.

4. Bitcoin Can Serve As A Medium Of Exchange

Fiat currencies have always been the popular medium of exchange across the world. But Bitcoin is beginning to gain traction in that light with the adoption of crypto assets as a payment method. Today, some companies accept Bitcoin payments instead of using cash or credit/debit cards.

This is important in the event of making cross-border payments, which can be a bit slow when using conventional payment methods. But you can send and receive Bitcoin from anywhere in seconds or probably a few minutes due to blockchain technology that makes transactions fast.

The realization of the quick confirmation of Bitcoin transactions that can improve customer experience during shopping has encouraged many businesses to integrate crypto payment gateways into their site. This gives customers the option of paying in cryptocurrency like Bitcoin during checkout.

5. Bitcoin Operates In A Liquid Marketplace

Are you still wondering why you should invest in Bitcoin? Bitcoin operates in a liquid marketplace, meaning you can enter and exit the market seamlessly. So, as crypto trading is one of the best ways to make money online, you can trade the coin on exchanges 24 hours a day.

You can adopt trading strategies such as crypto day trading or crypto arbitrage to leverage the market’s potential. This process is direct. You need to buy Bitcoin from an exchange and hold it until you want to sell it, mainly when the price increases, to make profits.

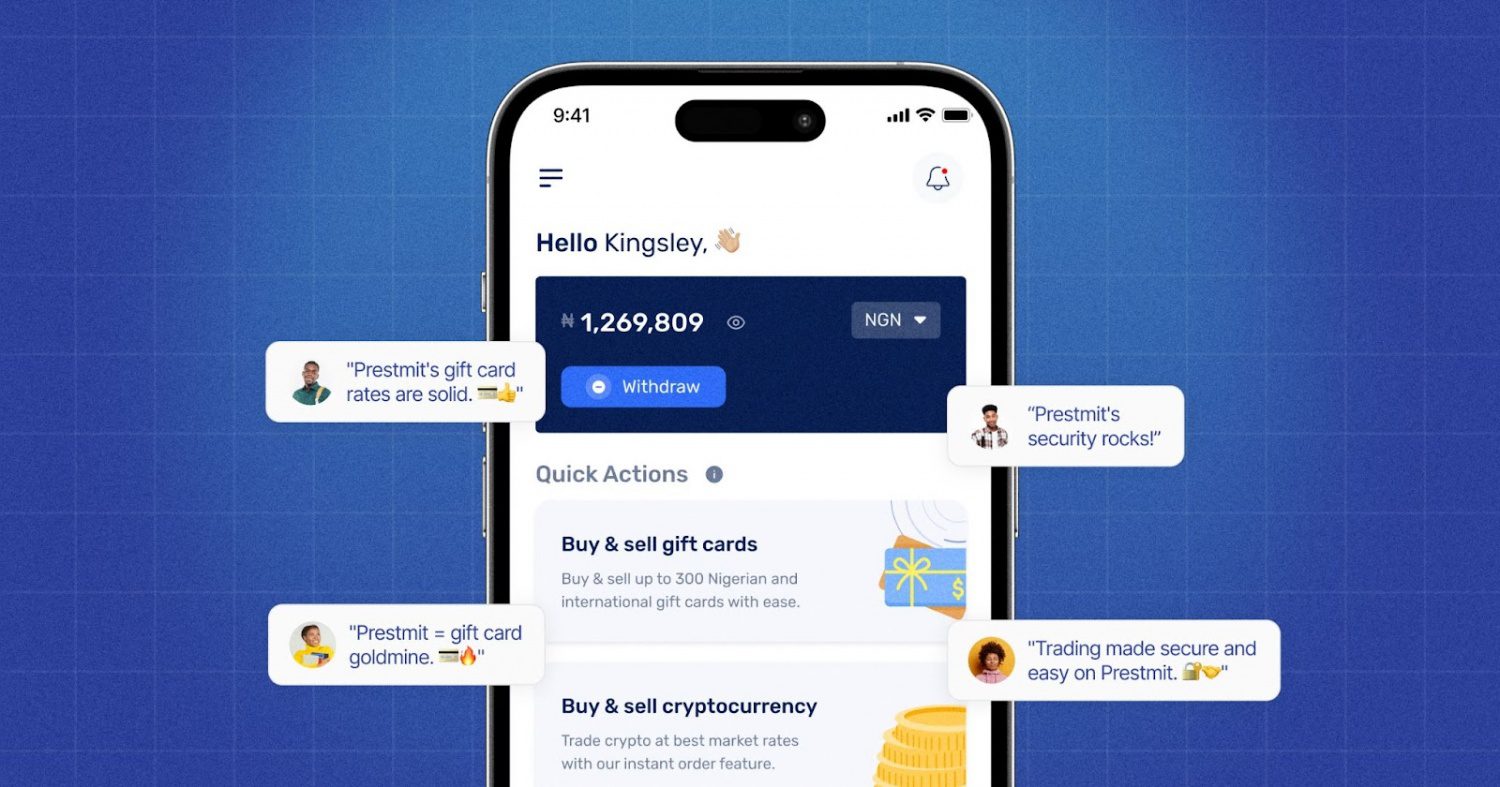

The process of purchasing Bitcoin is similar to when you want to sell, as you can also do that on exchanges for fiat or other cryptocurrency. But if you’re going to sell Bitcoin, you may consider using Prestmit.

This leading digital trading platform provides you with a multiple payment method, sophisticated security, a Bitcoin rate calculator, and other features that enable seamless and profitable trading.

How To Sell Bitcoin On Prestmit

Here are the quick steps to sell Bitcoin:

- Visit the official Prestmit website or download the Prestmit app on the Google Play Store or Apple Store.

- Create a Prestmit account and log in.

- Click “Crypto” and choose “Sell Bitcoin.”

- Copy the Bitcoin wallet address and follow the prompts.

- You will receive payment immediately after the transaction is confirmed.

Frequently Asked Questions (FAQs) About Investing In Bitcoin

Why Should I Invest In Bitcoin?

You can invest in Bitcoin because it has the potential for moonshot, and it is a good store of value with a track record of all-time highs.

Why Is Bitcoin Considered An Hedge Against Inflation?

Bitcoin hedges against inflation due to its limited supply, which is capped at 21 million caps. This scarcity ensures that Bitcoin is not subject to inflationary pressures such as fiat currencies that can increase its supply.

How Does Bitcoin Liquidity Benefits Investors?

Bitcoin’s liquidity means that you can easily convert the coin into cash or other assets with low transaction fees. This liquidity benefits short-term traders seeking quick profits and long-term investors seeking market stability.

Conclusion

Bitcoin has always been the face of the crypto market because of its wide use and potential for growth. This is why many people or entities are interested in investing in the crypto asset.

However, it is important to know that this is a volatile asset that can experience a bearish or bullish run at any time. So you must be cautious and invest responsibly when investing in Bitcoin

Last updated on August 14, 2025