Table of Contents

Satoshi Nakamoto mined the first Bitcoin in 2009 and since then, a further 19,898,062.5 BTC has been mined out of a possible 21 million. This implies that there’s roughly 1.2 million Bitcoin left to be mined. Out of this figure, an estimated 900 Bitcoins are currently mined per day. Miners make use of special hardwares to solve difficult mathematical equations and they earn Bitcoin as a reward. But is mining Bitcoin profitable?

There is no straightforward answer when it comes to answering this question. The profitability of Bitcoin mining depends on several connected factors. In this article, we’ll take a look at the factors that affect the profitability of Bitcoin mining, whether Bitcoin mining is profitable, how miners make profit and more.

What is Bitcoin Mining?

Bitcoin mining is the process of creating new bitcoins by solving complicated math problems that verify transactions in the currency. Bitcoin miners receive Bitcoin as a reward for ”blocks” of verified transactions, which are added to the blockchain.

Although Bitcoin mining is seen as a tough task due to its complex nature and high costs, it is still a way of earning from Bitcoin.

The word ”mining” used here is a metaphor for introducing or creating new Bitcoin into the system. This is used since it requires work just as mining for gold or silver.

How Does Bitcoin Mining Work?

During the early days of Bitcoin, you could easily mine blocks and earn rewards independently if you had a computer. However, the rise in Bitcoin’s popularity and price increased Bitcoin mining competition.

Bitcoin mining essentially became a race, and there was a surge in the computational power required to solve cryptographic puzzles. Miners who worked independently gradually discovered they had little or no chance of earning anything.

This was what gave birth to the rise of Bitcoin mining pools. A Bitcoin mining pool is a combination of individual miners who combine their computational resources to improve their chances of successfully mining Bitcoin.

With this collaboration, miners share their earnings based on their contributions. This is measured in terms of hash power—the computational effort expended in solving the cryptographic puzzles needed to validate transactions and create new blocks on the Bitcoin blockchain.

F2Pool is currently the biggest and most popular Bitcoin mining pool; it boasts an impressive hash rate of 35,000 and fees of 2.5%. They’re closely followed by Poolin, which is widely known for its user-friendly features and high performance.

Poolin has a hash rate of 25,000 and a fee of 2%. Other top Bitcoin mining pools are ViaBTC, with a 15,000 hash rate and a 4% fee; Slush Pool, with a 13,000 hash rate and a 2% fee; and Antpool, with a 12,000 hash rate and a 3% fee.

Whenever a Bitcoin is successfully mined, a block is added to the blockchain, making the miner earn a Bitcoin. For this to happen, Bitcoin miners must compete to solve highly complex math problems. Expensive computers and enormous amounts of electricity are required to perform this task.

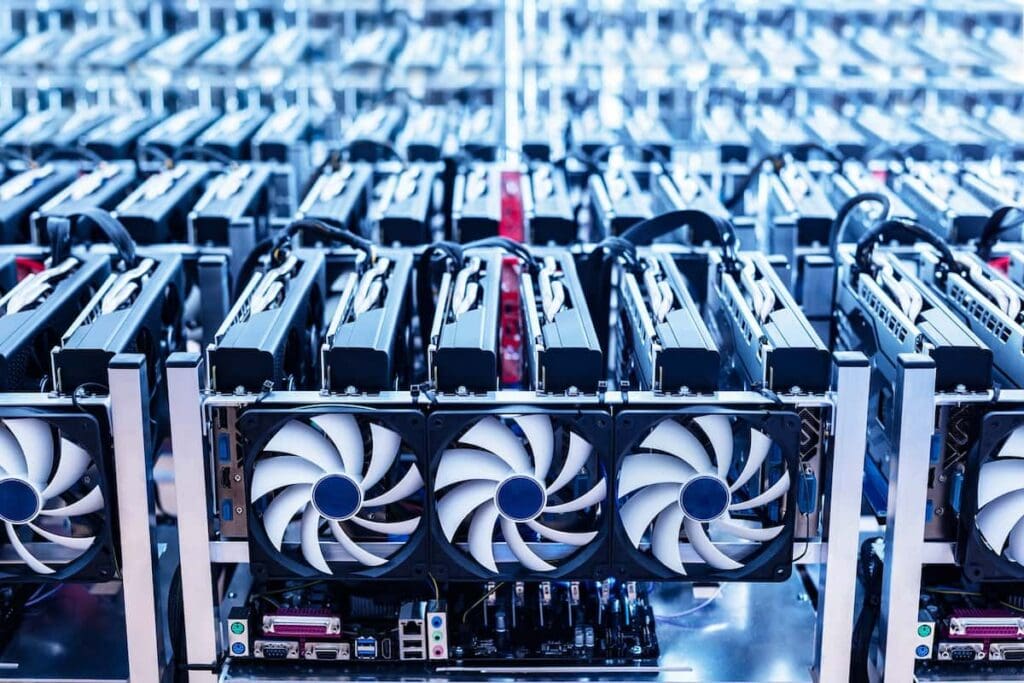

Bitcoin Mining Hardware

The computer hardware used is GPU (graphics processing unit) and ASICs (application-specific integrated circuits). Some of the most ASIC miner profitability comparison ranges are: Antminer: $1,320–$14,521, speeds from 120TH/s to 473TH/uxs and Whatsminer: $540–$8,569, speeds from 102TH/s.

Bitcoin miners look to generate a 64-bit hexadecimal number using a key called ”nonce” for the target hash. The first miners whose nonce generates a hash less than or equal to the target hash are awarded credit for completing that block.

In addition, the crypto mining electricity costs vary significantly based on the miner’s locations. Based on household electricity rates for mining, the ranges are very profitable in areas such as Iran, where mining one Bitcoin costs $1,324.17. However, miners in places like the United States pay over $321,112.30 to mine just a single Bitcoin.

How Much Does a Bitcoin Miner Earn?

If a Bitcoin miner is able to add a block to the blockchain successfully, they will receive 6.25 Bitcoin as a reward. The reward for BTC mining is reduced by half roughly every four years.

In 2009, when BTC was first mined, mining one block earned miners 50 BTC. This was halved to 25 BTC in 2012. By 2016, it was halved to 12.5 BTC, then 6.25 BTC in 2020. The Bitcoin halving event in 2024 reduced miner’s reward to 3.125 BTC.

Meanwhile, the profitability of Bitcoin mining depends on several key factors, with the most important being the current market price of Bitcoin. When the market value is high, miners can potentially earn more after deducting equipment and electricity costs.

You can utilize an online mining calculator to determine whether your mining efforts will be profitable.

For this example, you can use BTC.com’s Bitcoin mining ROI calculator, which is comprehensive and uses the pay-per-share payout method, a common approach used by mining pools. The values used here are based on the Antminer S19 XP, a popular mining system.

What You Need for Bitcoin Mining

These are the basics you’ll need to start mining Bitcoin;

1. Digital wallet

Transactions involving cryptos are impossible without wallets. It is where any BTC you earn after you’ve successfully mined will be stored. A digital wallet is an encrypted online account that allows you to store, transfer, and accept BTC or other cryptos.

2. Mining software

You can download the mining software and run it on Windows & Mac computers. Once the software is connected to the necessary hardware, you’ll be able to mine.

3. Computer hardware

This is the most expensive equipment you’ll need to mine. You’ll need a powerful computer that uses an enormous amount of electricity in order to mine Bitcoin successfully. This computer hardware can cost you up to $10,000.

Why Bitcoin Mining is Risky Today

Bitcoin mining is a financial risk as one could go through all the effort of purchasing expensive equipment for mining without a return on investment. The risks involved could be as a result of;

1. Price volatility

Bitcoin’s price has varied widely since it debuted in 2009. The volatility in price makes it difficult for miners to know if their reward would outweigh their investment in mining.

2. Regulation

Several governments of nations in the world are yet to embrace Bitcoin. Investing in it is a risky venture because it is not controlled by the government. Additionally, there is always the risk that governments could outlaw the mining of Bitcoin or other cryptos. The fear of such regulations on the use of Bitcoin keeps people away.

What Are the Alternatives to Bitcoin Mining in 2026?

1. Litecoin Mining

Litecoin mining is a great alternative to Bitcoin mining, especially if you’re a beginner. Litecoin is similar to Bitcoin, except for some key differences that make it more accessible. Litecoin processes transactions much faster, with block times of just 2.5 minutes compared to Bitcoin’s 10 minutes.

It uses a proof-of-work (PoW) mechanism with a different algorithm called Scrypt. This algorithm is less energy-intensive and requires less memory, making it a bit easier to mine than Bitcoin. However, you’ll still need some solid hardware to get started. Overall, Litecoin is a well-known and reliable cryptocurrency that’s worth considering for beginners.

2. Ethereum Classic Mining

Ethereum Classic is another top alternative to Bitcoin. Ethereum Classic is still based on the same Proof-of-Work system as the original Ethereum, making it more accessible.

What’s more? You don’t need to break the bank on expensive hardware to get started – a decent GPU with 4GB of VRAM will do the trick. And if you’re looking for more power, you can always consider using an ASIC rig. Just be sure to choose a GPU with a good balance of processing power and energy efficiency.

3. Monero Mining

Mining Monero is a great option if you’re looking to mine crypto. What makes it so accessible is that it uses an algorithm called RandomX, which allows you to mine with your regular computer’s CPU.

You don’t need specialized hardware like ASICs, which are typically required for mining other cryptos like Bitcoin. If you have a decent computer, like a gaming PC with a powerful processor from AMD or Intel, you can start mining Monero from your home.

Some CPUs, such as the AMD Ryzen 9 5950X or Intel i9-10900K, are particularly well-suited for mining Monero due to their high hash rates, which enable them to quickly solve the complex math puzzles required to earn Monero rewards.

Frequently Asked Questions (FAQs) About Bitcoin Mining Profitability

How much can you make mining Bitcoin in 2026?

There is no fixed amount you can earn when you mine Bitcoin. The amount is usually split between the miners based on their contributions.

What’s the minimum investment needed for Bitcoin mining?

The minimum investment varies based on the location of the miner. For instance, a miner in Iran can expect to spend roughly $1,500, while their counterpart in the US could spend close to $350,000

Is GPU mining Bitcoin still profitable?

Yes, GPU mining Bitcoin is still profitable.

Conclusion

Bitcoin mining has long been the primary way people earn from Bitcoin. Although trading or long-term investing is now the more popular crypto route to earning or building wealth, one can still say bitcoin mining is profitable even in 2026. The price of Bitcoin may be low at the moment, but in the long run, it takes an upward trajectory.

For those looking to make a quick buck, Bitcoin mining may not be profitable, considering the cost of setting up. The equipment and amount of electricity required may cost more than a miner may earn now. So, if you’re not already set up, it may be advisable to try other means of earning from Bitcoin.

Last updated on August 21, 2025