Crypto trading continues to gain traction in Nigeria as it is one of the best ways to make money online. But as there are different platforms to trade your asset, are you aware of KuCoin’s decision to impose 7.5% VAT on transaction fees for Nigerian users? This is worthy of note as a Nigerian crypto trader, as it gives you insight into what the decision means for you when you are using the platform in Nigeria. So let’s dive deep into this discourse for your better understanding.

An Overview Of KuCoin’s 7.5% VAT On Transaction Fees

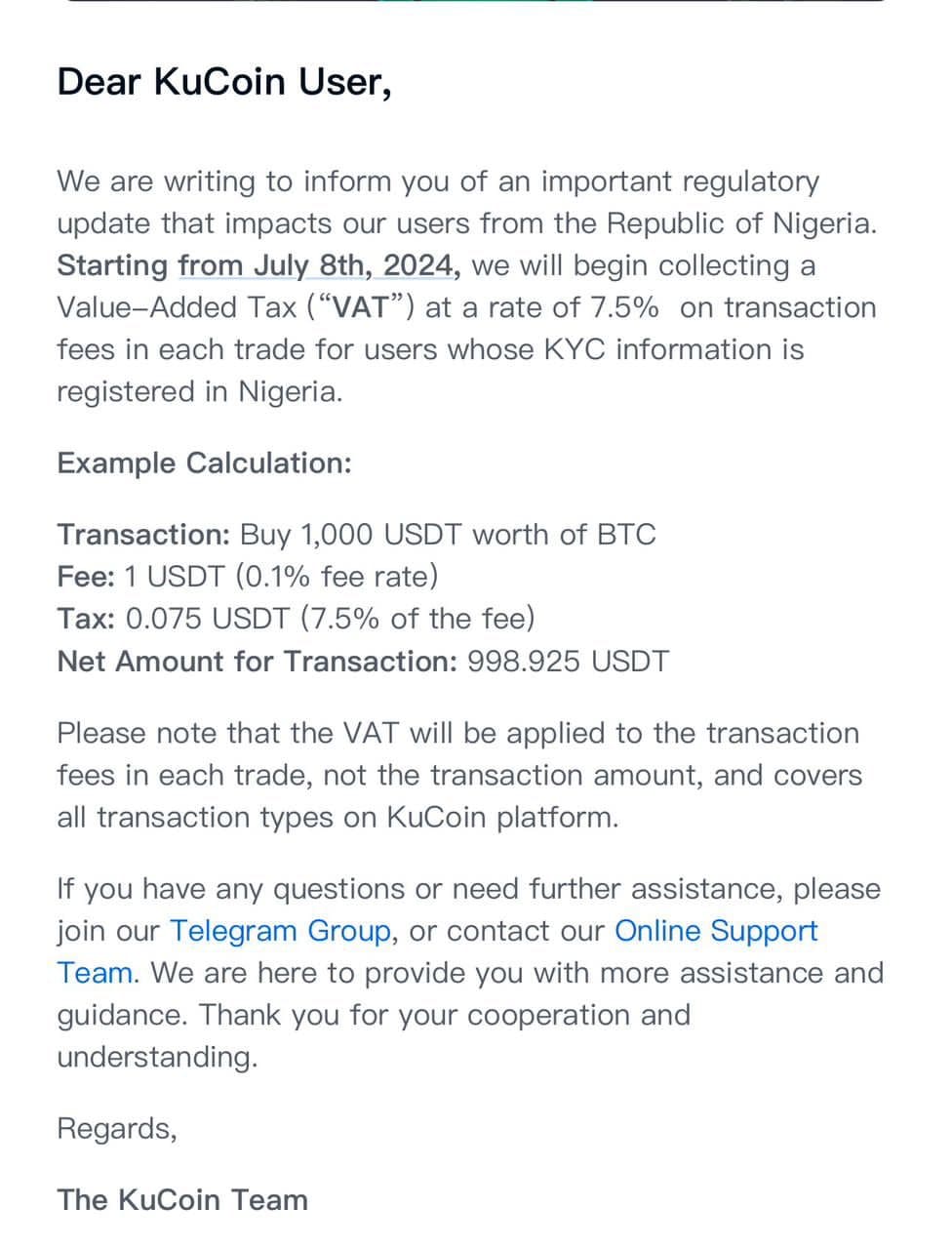

Global crypto exchange KuCoin disclosed that it will begin a 7.5% VAT (value-added tax) on the transaction fees of all its users in Nigeria, taking effect from July 8, 2024. This is contained in an email sent to all its Nigerian users, with the Federal Inland Revenue Service (FIRS) requirements.

This latest development has raised concerns in the crypto community about whether the VAT applies only to P2P trades involving the naira or all crypto transactions conducted on the platform. KuCoin 7.5% VAT for Nigerian users

Reacting to KuCoin’s decision, Dare Adekanmbi, Special Adviser on Media to the FIRS chairman told a local news outlet, Punch that “By the decision to inform its clients that VAT will henceforth be charged on transactions on its platform, KuCoin has demonstrated readiness to comply with the extant tax laws in Nigeria, and this should be commended.”

“We at FIRS are glad that corporate organizations are showing readiness to comply with the laws of the country as far as revenue collection is concerned. This is what a responsible corporate body should do without being prompted or press-ganged,” he added.

Notably, the Nigerian authorities have been taking stringent actions on crypto exchanges and peer-to-peer (P2P) trading since the beginning of 2024 without much clarity on crypto regulations. Binance has particularly been targeted over alleged Nigerian naira manipulation, making the Nigerian crypto community wonder if the government plans to ban crypto.

Recall that the Federal Government of Nigeria banned Binance earlier in the year and also directed blocking access to crypto exchanges operating in the country, including KuCoin, to stem the tide of constant naira devaluation.

Earlier in May, KuCoin bowed to regulatory pressure by shutting down its P2P platform as Binance also ended its naira services following the detainment of two of its executives.

Mixed Reactions Ensued Among Nigerians

KuCoin’s decision has generated mixed reactions from Nigerians as some people see it as a signal that the Nigerian government fully recognizes and legalizes cryptocurrencies. However, others believe that the move is justifiable considering how crypto transactions have been criminalized by the actions of the Central Bank of Nigeria (CBN) and law enforcement agencies.

An X user expressed his displeasure with KuCoin’s announcement as he asked Nigerian traders to boycott the platform until the VAT is removed. He stated that the Nigerian government should legalize cryptocurrency if they want to tax the digital assets.

Lucky Uwakwe, Chairman of the Blockchain Industry Coordinating Committee of Nigeria (BICCoN), raised questions about the decision.

He said,

“First, on collection, reporting, and remittance, how does the Nigerian government know that the number of Nigerian users as stated by KuCoin is true? How will the Nigerian users get proof that the VAT charged gets to the government revenue purse? Also, how does KuCoin remit the collected 7.5% VAT considering that the transaction is a crypto transaction, not naira?”

Uwakwe further questioned if the CBN will permit banks and other financial institutions to facilitate crypto-related transactions with their bank accounts, considering the 7.5% revenue the country will make from every transaction fee on KuCoin.

Also, Chris Ani, in a Twitter Space, criticized the Nigerian government’s approach to the crypto industry, lamenting the lack of proper regulation on the sector based on the rule of law. He also emphasized how imperative it is for the government to properly classify crypto to determine what tax applies and who regulates what.

Meanwhile, Adedeji Owonibi, Founder/COO at Convexity and Senior Partner, A&D Forensics, stated on his LinkedIn Page, “Seems like Christmas is over for Nigeria centralized cryptocurrency exchange users as the Federal [Government] of Nigeria wants its cut via VAT payment to the FIRS. Expect this from all exchanges operating in Nigeria going forward, this is a natural flow, let’s embrace the change and be good corporate citizens.”

Crypto Tax Regime In Nigeria

Some countries across the world are already having crypto tax in place, which seems like a positive nod for crypto trading. Talking about the crypto tax in Australia and the crypto tax in Canada, these countries are charting the course for recognizing cryptocurrencies as either commodities or securities.

However, it remains unclear whether VAT applies to virtual assets in Nigeria despite its VAT legislation charging a tax rate on qualified goods and services. This uncertainty is owed to the government’s anti-crypto stance over the years.

In May 2023, Nigeria introduced a capital gains tax on digital asset investments through the provision of the Finance Act 2023, as the tax is 10% in the country. But to date, the FIRS has yet to issue any guidelines on how digital asset owners will pay their capital gain tax after disposing of their assets.

Frequently Asked Questions (FAQs) About KuCoin’s 7.5% VAT For Nigerian Users

When Will KuCoin’s VAT For Nigerian Users Start?

According to KuCoin’s announcement, the VAT imposition started on July 8, a decision that the FIRS has lauded as a welcome development.

What Is The Alternative To Trading On KuCoin?

Prestmit is the best alternative to trading on KuCoin. This hinges on the platform’s innovative features and low trading fees compared to the VAT imposed by KuCoin. Prestmit has also been one of the best alternatives to Binance since the suspension of naira services on the exchange.

Is There A Guideline For Crypto Tax In Nigeria?

There is yet to be a guideline for crypto tax in Nigeria. However, the 7.5% VAT on transaction fees that were introduced by KuCoin is perceived to be the exchange’s move to be on the good side of the Nigerian government.

Conclusion

The crypto industry is gaining momentum in Nigeria despite the government’s stringent approach to clamping it. But as the crypto market is expanding in the country, crypto exchanges are trying their best to remain in the thriving market by meeting certain requirements, just as KuCoin’s 7.5% VAT on transaction fees for Nigerian users.

Nonetheless, you can trade with relatively lower fees on Prestmit, which is an over-the-counter (OTC) that is fast, safe, and easy to use.