Table of Contents

Solana is rapidly earning a reputation as one of the most groundbreaking innovations in the digital payments space. Its payment protocol, Solana Pay, is designed not only to facilitate lightning-fast transactions but also to integrate seamlessly with the broader Web3 ecosystem, including nonfungible tokens (NFTs).

This forward-looking approach positions Solana Pay as more than just a payment tool—it is being hailed by some as the “Visa or PayPal of Web3.” Such comparisons highlight its potential to redefine how value moves across the internet.

This article takes a closer look at Solana Pay—what it is, how it works, and why it matters—helping you determine whether this ambitious project truly lives up to the hype. But before diving into its payment protocol, it is essential to first understand the foundation on which it is built: the Solana blockchain itself.

What Is Solana Pay?

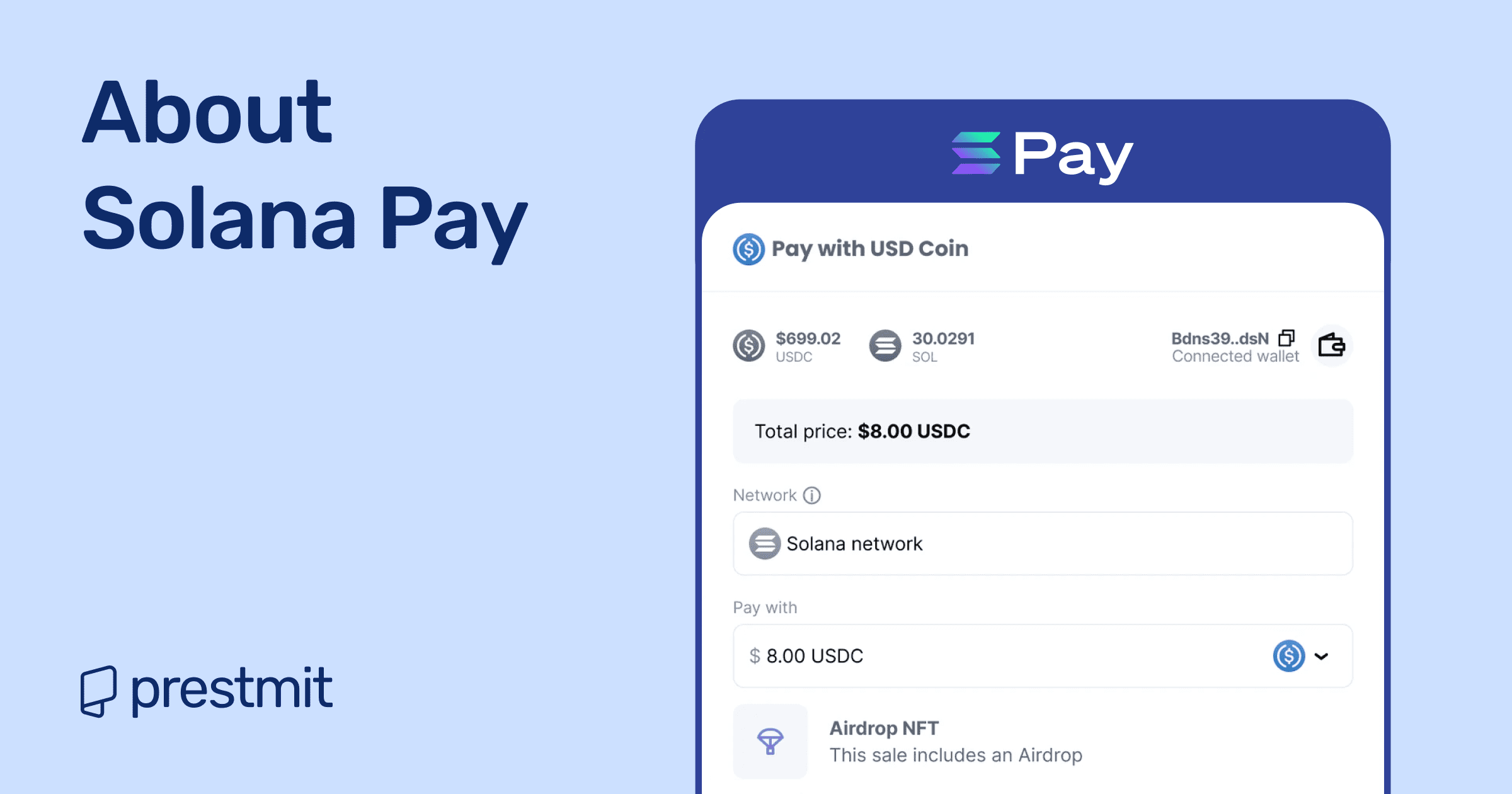

Solana Pay is an open-source, next-generation payment protocol on the Solana blockchain to facilitate frictionless, decentralized commerce. Peer-to-peer transactions between merchants and consumers are facilitated, doing away with the necessity of using costly middlemen. It operates via dynamic payment request URLs, which can be embedded in websites or displayed as QR codes to allow users to authorize payments immediately from their crypto wallets.

With settlement rates nearing real-time, under-a-cent transaction fees, and natively supported SPL and SOL tokens, Solana Pay is an innovative payment solution. As more e-commerce platforms like Shopify increasingly adopt it, it also bridges the gap between blockchain technology and mainstream retail, facilitating borderless, transparent, and efficient digital payments.

How Does Solana Pay Work?

Solana Pay is built on the Solana blockchain, a high-performance blockchain that enables payments at lightspeed and negligible cost. Essentially, the platform synchronizes businesses and customers to transfer value in real-time without the delays, fees, and intermediaries of traditional payment systems.

Each transaction is verified on the blockchain directly, so it’s secure and transparent, and Solana’s energy-efficient design reduces its carbon footprint. The network is also able to handle 65,000 transactions per second and can scale up enough to meet global on-demand commerce.

Integration is also made easy for businesses with Solana Pay’s software development kit (SDK). The kit allows merchants to add payment capabilities into existing apps, websites, or retail infrastructure without much hassle.

Customers can pay instantly via their crypto wallets, while merchants receive the money instantly upon integration. Settlement is also dynamic, giving merchants the ability to settle payments in cryptocurrency or convert them to fiat currency in real-time.

DApps developers can also embed Solana Pay into their websites, enabling frictionless payments across the Web3 universe. Existing retailers, however, require a Solana wallet in order to accept payments, and they get to benefit from a sophisticated digital infrastructure without complex infrastructure.

This ease of implementation makes Solana Pay rival PayPal. While PayPal facilitated online payments to be fast and simple, Solana Pay aims for the same for cryptocurrencies—to bridge the gap between cryptocurrency and normal commerce.

Advantages of Solana Pay

1. Fast Speed

One of the strongest advantages of Solana Pay is its speedy processing of transactions. Payments are verified within less than a second, making checkout seamless and removing the extended waiting period like most typical traditional banking systems. Such speed favors businesses that require instant verification of payments to drive customer satisfaction and reduce cart abandonment on checkout.

2. Very Low Fees

Solana Pay is distinguished and preferred because its transactions are below $0.01. This extremely low cost enables businesses to facilitate even micropayments without worrying about large fees cannibalizing profits. Unlike traditional payment processors that debits huge sums for every transaction, Solana Pay keeps both merchants and consumers happy with their low cost transaction policy, enabling more savings and wider access to global digital commerce.

3. Borderless Payments

Another advantage is that Solana Pay facilitates borderless payment without the hassle of cross-border currency exchange. Consumers everywhere in the world can pay merchants directly in cryptocurrency, bypassing middlemen financial institutions that typically charge high fees for cross-border payments. This opens up new possibilities for cross-border trade, allowing even small merchants to sell worldwide without fear of limitations or high-priced banking intermediaries.

4. Blockchain Transparency

Solana Pay functions through the blockchain technology, in which every payment is recorded on an open ledger. This transparency builds responsibility and trust among customers and merchants, as accounts cannot be altered or hidden. In contrast with traditional systems where disputes can be tedious, blockchain authentication allows for a clear, immutable record of payments, which reduces the chance of fraud and builds confidence in transactions.

5. Flexible Settlement

Business owners who use Solana Pay enjoy ease and flexibility in how they receive payments. They can either hold payments in cryptocurrency or exchange them to fiat currency right away as they see fit. This feature gives companies leverage over their money, which allows them to manage volatility risks without sacrificing the speed of blockchain transactions.

Limitations of Solana Pay

1. Constant Change

The most significant challenge for Solana Pay might be the volatility of cryptocurrency. The value of the payment can change incredibly fast in a couple of minutes, and the merchant won’t be able to account for their profit. This volatility is risky to those businesses that carry thin margins and need predictable cash flows to meet operating expenses, payroll, and everyday costs effectively.

2. Limited Merchant Adoption

Even though Solana Pay is novel, it has not yet achieved the level of popularity like most traditional payment channels like Visa or PayPal. Companies primarily employ tested processors, limiting where users can utilize Solana Pay. Until then, users may be limited in their spending options, making it less convenient than well-established international payment systems.

3. Technical Setup

Deploying Solana Pay requires some knowledge of blockchain technology. As it is not plug-and-play like traditional payment processors, companies may require technical assistance or the expertise of developers to correctly deploy it. This need discourages small merchants or inexperienced users that lack familiarity with cryptocurrency, slowing down the adoption level even with the potential of these systems, and the benefits it offers.

4. Network Outages

Though Solana Pay is programmed not to disappoint, the Solana blockchain itself has been struck with network downtime previously. During such instances, the users couldn’t make payments or even access their wallets, creating extreme trust issues. For businesses, system downtime in a payment system can result in loss of revenue and frustrated customers, so reliability is an important aspect to consider.

5. Regulatory Uncertainty

Laws regarding cryptocurrency vary from country to country, and Solana Pay is not exempted from this challenge. There are nations that accept payments in crypto, and others with strict legal controls or lack of clear guidelines. This uncertainty can make things difficult for merchants who are trying to adhere to laws in multiple jurisdictions, thereby, reducing the scalability and long-term viability of using Solana Pay globally.

Wallets That Support Solana Pay

1. Phantom Wallet

Most people who use Solana make use of this wallet. It simplifies everything; you can send, receive, and store your tokens, and it works flawlessly with Solana Pay. Just scan a QR code, and you’re done. It has a straightforward design and browser extension that makes both people buying things and businesses accepting payments enjoy it.

2. Solflare Wallet

Solflare is a wallet that works for both mobile and desktop. Thanks to its flawless integration with Solana Pay, you can complete a payment in seconds by scanning a QR code. The whole design is super clean and easy to use, so even if you’re new to crypto, you’ll get the hang of it right away. Plus, it keeps your assets safe and sound.

3. Glow Wallet

If you’re just looking for a simple, fast way to pay, Glow is a great option. It’s a lightweight Solana wallet designed just for quick and easy payments. It works seamlessly with Solana Pay and lets you scan a QR code and complete a transaction in seconds. The interface is super minimal and clean, so even if you’re new to crypto, it’s really easy to pick up and use, all while keeping your assets secure.

4. Ledger Nano (with Solana Apps)

When a merchant wants maximum security, the Ledger Nano hardware wallet is a great choice. You just connect it, use the Solana app, and you’re good to go. You can process Solana Pay transactions while your funds stay locked away in cold storage. It favours both parties, quick payments for business and solid security for the long-term.

Frequently Asked Questions (FAQs) About Solana Pay

Is Solana Pay safe to use?

Yes! Solana Pay uses blockchain encryption to secure everything, so there’s no need for a third party to get involved. Once a payment is made, it’s verified right there on the blockchain. This way, the transaction cannot be reversed and it is completely transparent. Both the business and its customers are covered.

How do I start using Solana Pay for my business?

You’ll need to integrate it with your existing system, either using a supported wallet or a payment plugin. Then you just create the QR codes or payment links and connect them to your point-of-sale or online store. You’ll also tell it where you want the money to go.

What wallets are compatible with Solana Pay?

Solana Pay gives merchants options. You can use popular wallets like Phantom or Solflare, or even something as simple as Glow. If your business needs extra security, a Ledger Nano hardware wallet is what you need. These all let you receive payments securely, and they make paying super fast and easy for your customers.

Conclusion

Solana Pay is taking digital transactions to the next level, thanks to their speed, affordability, and global reach. While it is not without its flaws, its advantages are a lot more especially for businesses looking to embrace crypto payments. As people are slowly adopting blockchain payments, Solana Pay is in the forefront as a forward-thinking solution for the next era of commerce.

Last updated on August 21, 2025