Table of Contents

Payment gateways are revolutionizing the way we transfer and receive money. This is because they are efficient and convenient to use. Nearly one in five Americans doesn’t have a traditional bank account, but they still need ways to send money, pay bills, or shop online. Venmo is one of these payment methods that enable you to make online transactions across the world. But as most transactions involve a bank account, you can actually send money without a bank account on Venmo. As interesting as this might sound, you must know how to add money to Venmo without a bank account.

In this article, we’ll explore the different ways to fund your Venmo account without a bank, explain fees and limits, share security tips, etc.

Why Add Funds to Venmo Without a Bank Account?

1. No stress of linking to a bank account

Some people don’t have a bank account they trust for online payments. Others simply don’t feel comfortable sharing their banking details with an app. Using alternative funding methods lets you keep your main financial information private while still being able to use your Venmo balance.

2. Faster access to money

Bank transfers can take a while, especially if you’re waiting for funds to clear. Certain non-bank options give you quicker access to money. You can add funds instantly or receive money directly into your balance without going through the traditional transfer process. This helps if you need to pay for something right away.

3. Easy peer-to-peer transfers

If friends, roommates, or family already use Venmo, you can receive money from them anytime. Those transfers land in your balance immediately, so you can spend the money without ever linking a bank account. This makes it feel more like a shared wallet among the people you interact with regularly.

4. Backup options when bank linking fails

Sometimes linking your bank account hits snags like verification taking too long, the app might keep rejecting the connection, or your bank could have restrictions. Having other ways to fund your account means you’re not stuck waiting for the link to work. You can still use the app normally while you sort it out.

5. Can be used like a prepaid wallet

Your Venmo balance can be used like a prepaid card. You can add money from alternative sources, receive transfers from others, and then spend directly from their balance. This setup keeps everything in one place and avoids mixing it with your primary banking activity.

Ways to Add Money to Venmo Without a Bank Account

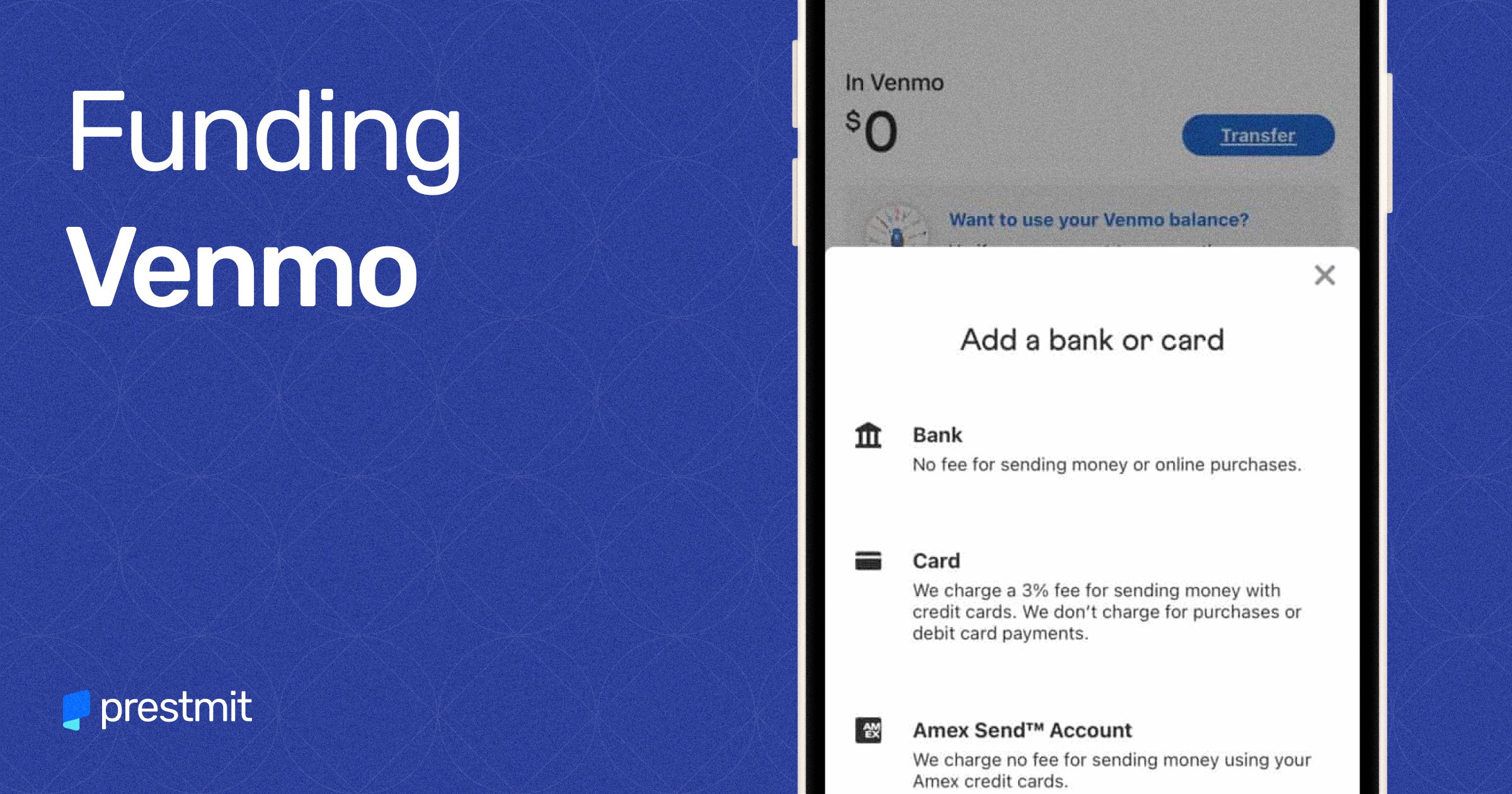

1. Add funds through a debit or prepaid card

You can link a Visa or Mastercard debit card, or a major prepaid card, to your Venmo account. Once linked, you can use the card to add money to your Venmo balance or make payments directly from the card. Keep in mind that not all cards or issuers allow this, and some may charge fees for card transactions. Using a prepaid card can be useful if you want to keep your bank account separate.

2. Receive direct deposit

Venmo provides account and routing numbers that you can use to receive direct deposit from your employer, government benefits, or other issuers. Money sent via direct deposit goes straight into your Venmo balance, eliminating the need to link a traditional bank account. To use this feature, you’ll usually need to complete identity verification within the app.

You can directly deposit funds into your Venmo account balance through the following steps:

- Open the Venmo app on your desktop or mobile app.

- Navigate to “Settings” to choose the “Direct Deposit” option.

- Choose “Show Account Number” to copy “Account Number” and “Routing Number.”

- Paste all the details in the Direct Deposit Information form.

- Upon completing this process, direct deposit on your payment account would have been enabled so people can deposit money directly into your Venmo account.

3. Receive Money from Friends or Family

Anyone with your Venmo username, phone number, or email can send money to your account. These payments are added directly to your Venmo balance, giving you funds to spend without ever connecting a bank account. Once you have a balance, you can use your Venmo card or make Venmo payments to cover purchases.

4. Add money through mobile check deposit (Venmo card required)

If you have a Venmo debit card, the app allows you to deposit checks directly into your Venmo balance using your phone’s camera. This gives you another way to add funds without linking a bank account. The process is quick, and funds are usually available according to Venmo’s check deposit policies.

Here are the steps to do this:

- Open your Venmo account on the web or mobile app.

- Click “Manage Balance” and navigate to choose “Cash a Check.”

- You will be directed to a page requiring you to enter the amount you want to add or deduct.

- You need to e-sign the check to continue this process.

- Submit clear photos of both sides of the signed check.

- Choose how soon you want to be able to access your money.

- If your check is approved, you will be asked to mark the front “VOID” and upload another photo to prove it has been voided.

- Your fund transfer will be processed, with the cheque taking between seven (7) and ten (10) days to be cleared and shown in your Venmo account balance.

What Are the Fees and Limits About Using Venmo?

1. Card Funding Fees

Adding money or making payments using a linked debit or prepaid card may cost more than using a bank transfer. If you use a credit card, the fee for payments is usually around 3%. Fees for loading funds may vary depending on the card type and issuer. Always check before funding to avoid surprises.

2. Limits on amounts you can add or use

Non-bank funding methods often come with lower weekly or monthly limits. For example, topping up your Venmo balance via debit card without linking a bank account may have a weekly limit of about $2,000. Bank-based transfers typically allow higher limits, so consider this if you need to move larger amounts.

3. Direct deposit fees

Receiving money via direct deposit usually has no extra fee. However, you must qualify for direct deposit and wait for your employer or issuer to process payments. Funds appear in your Venmo balance according to your employer’s payroll schedule.

Security Tips to Consider in Using Venmo

1. Enable two-factor authentication (2FA)

Add an extra layer of security to your Venmo account by enabling 2FA. Use a passcode or PIN, and if your device supports it, set up a fingerprint or Face ID. This helps protect your account even if someone obtains your password.

2. Use strong, unique passwords

Never reuse passwords from other apps. Create strong, unique passwords for your Venmo account. You can use a password manager to help you generate and store complex passwords safely.

3. Complete your identity verification

Venmo may require identity verification for features like direct deposit or higher transaction limits. Completing these steps grants you access to more features and also helps secure your account.

4. Review linked payment methods regularly

Your account may have debit/prepaid cards or direct deposit information attached even without a bank account linked so always check and remove any unfamiliar or unused payment methods.

5. Maintain your device’s security

Keep your app and operating system up to date. Use a screen lock on your phone, and avoid accessing Venmo on public or unsecured WiFi networks to reduce the risk of hacks.

6. Watch out for phishing and scams

Be careful with unsolicited messages or requests. Scammers may “accidentally” send money and ask you to send it back, or offer suspicious funding schemes. Only send money to people you know and trust.

7. Monitor your balance and transactions

Check your Venmo balance and transaction history regularly. Watch for unauthorized outgoing payments or unexpected changes in funding methods. Immediate action can prevent bigger losses.

8. Avoid leaving large amounts idle

Venmo balances do not carry the same protections as bank deposits. Transfer large sums to a more secure account if you don’t need them immediately.

Frequently Asked Questions (FAQs) About Funding Venmo Without a Bank Account

Can I use Venmo without ever linking a bank account?

Yes. You can use Venmo without linking a traditional bank account. However, certain features (like “Add Money to Balance”) may be limited unless you have extra verification or the Venmo debit card.

Can I add money to my balance if I only have a debit card (or prepaid card)?

In many cases yes. You can link a debit/prepaid card and use it to fund your Venmo account. But Venmo sometimes restricts “add money manually” unless you have the Venmo debit card and you’re verified.

Is there any risk of my funds being lost or not protected?

Yes, while Venmo is widely used, funds stored in the app via non‑bank methods may not always carry the same protections as FDIC‑insured bank accounts. So you should avoid huge balances and transfer out if you’re saving your money long‑term.

Can I deposit cash directly into Venmo without a bank?

Not through Venmo’s standard “Add Money.” Venmo doesn’t currently support loading cash at retail locations into your balance in the same way some prepaid cards do.

Can I still spend the balance if I receive money from a friend and then link a bank?

Yes. Once the money hits your balance it’s available (subject to any holds). Later you can link a bank if you want. Receiving money from other users is one of the easiest ways to build your balance without a bank.

Are there minimums or maximums for adding money without a bank account?

Yes. Venmo imposes limits on how much you can send or add depending on verification status and method. Without full verification and bank link, your weekly/monthly limits may be significantly lower.

Can I move the balance from Venmo to cash or another account if I don’t have a bank?

Moving balance out to a bank requires linking a bank account in most cases. Without a bank you’re more limited: you can spend the balance via your Venmo card (if you have it) or use it for payments within Venmo.

Conclusion

Adding money to your Venmo account without a bank account is a viable and flexible option for many users. You can build a balance and spend from it without ever linking a checking account whether you’re using a prepaid/debit card, receiving direct deposits into Venmo, having friends send you money, or cashing checks through the Venmo card. However, you need to keep in mind that adding money to your Venmo account without a bank account might attract higher fees, lower limits, sometimes longer processing times, and slightly reduced protections compared to a traditional bank account funding path.

Last updated on November 19, 2025