Table of Contents

Cryptocurrency trading has grown into a global ecosystem with millions of users moving digital assets every day. But before anyone buys, sells, or swaps a coin, they must choose a platform and this decision usually comes down to two major options: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

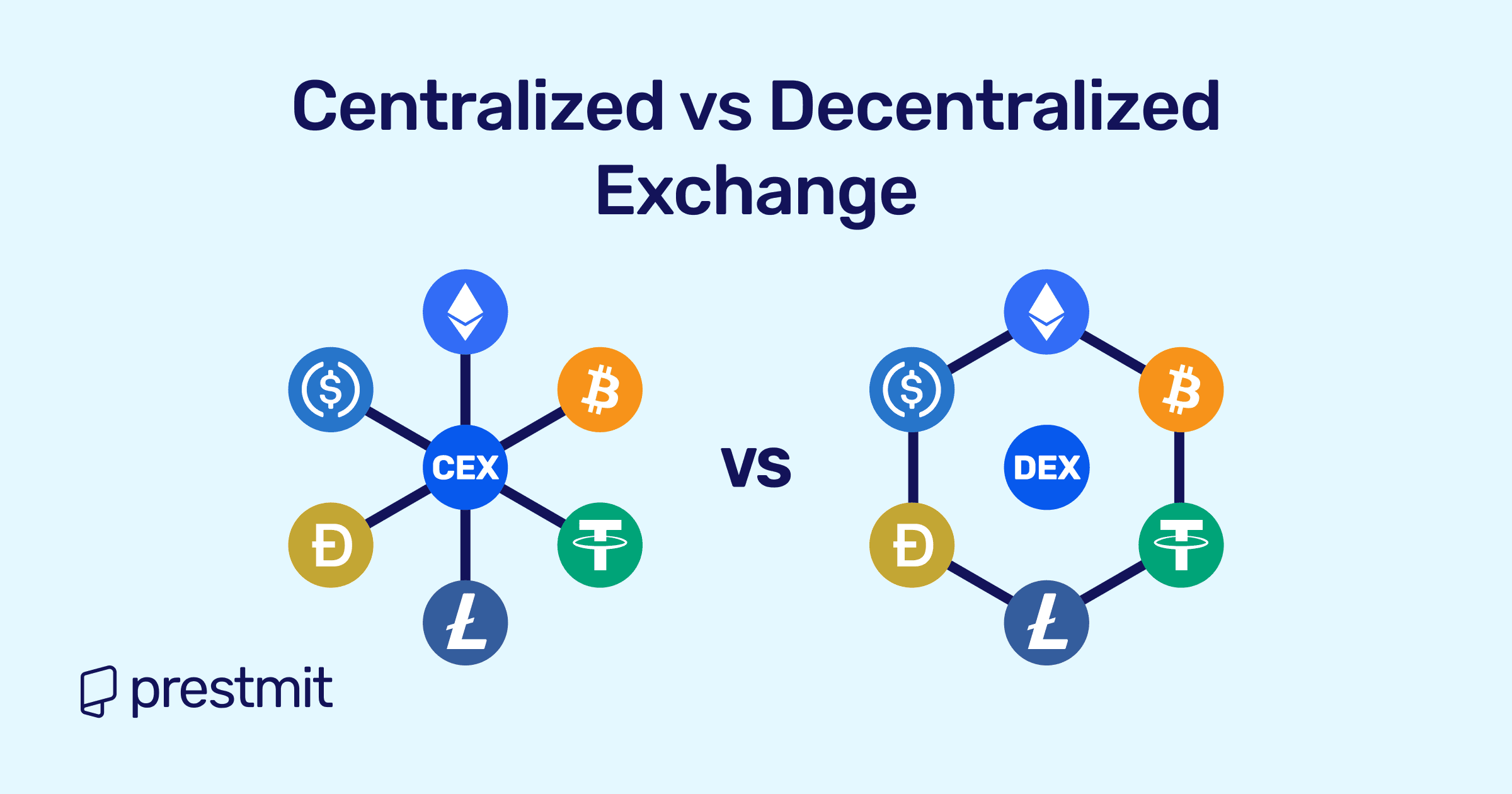

Both platforms allow users to trade crypto, but they operate in completely different ways. Centralized exchanges rely on an intermediary to manage trades, while decentralized exchanges allow users to interact directly from their own wallets without handing control of their assets to a third party. As the crypto market matures, the debate between CEXs and DEXs has become even more important for traders who want the right balance of security, speed, privacy, and convenience.

This article breaks down how each type of exchange work, their advantages and limitations, and how they compare in real-world use to give you a clear understanding of which one better aligns with your needs as a crypto trader.

What Are Centralized Exchanges?

Centralized exchanges (CEXs) are crypto trading platforms run by a company that manages the entire trading process on behalf of users. Think of them as the “banks” of crypto, highly organized, easy to use and built to make buying or selling digital assets as simple as clicking a button.

When you open an account on a centralized exchange, you deposit your funds into the platform’s custody. The exchange then processes your trades internally, matches buyers with sellers, and maintains your account.

Platforms like Binance, Coinbase, and Kraken became popular because they eliminate the complexity of direct exchange with blockchain networks. But this convenience comes with a trade-off: the exchange controls your funds. It holds your assets, stores your data, and becomes the central point of trust and risk.

What Are Decentralized Exchanges?

Decentralized exchanges (DEXs) are crypto trading platforms that operate without a central authority. Unlike centralized exchanges, DEXs allow users to trade directly from their own wallets, giving them full control over their funds and private keys. There’s no intermediary managing transactions, trades are executed through smart contracts on the blockchain.

This structure offers greater privacy, transparency, and security since users retain control of their assets at all times. Popular examples include Uniswap, PancakeSwap, and dYdX, which provide access to a wide variety of tokens without requiring KYC verification.

With DEXs, there is reduced reliance on third parties, minimized hacking risk, and greater financial autonomy. However, they can be less user-friendly for beginners, they have lower liquidity than major centralized exchanges, and often require users to pay blockchain network fees for each transaction.

With both types of exchanges defined, the next step is to examine how they differ in practice.

Centralized Exchanges vs Decentralized Exchanges: Key Differences

Below are the major distinctions that define how CEXs and DEXs work and what you can expect when using them.

1. Custodial vs Non-Custodial Wallets

Centralized exchanges hold user funds in platform wallets, while decentralized exchanges let users trade directly from their own wallets, keeping full control of their assets.

2. User Control

Centralized exchanges manage private keys, making trading simpler but requiring trust in the platform. Decentralized exchange on the other hand gives users full control over their keys and funds, but they must manage security themselves.

3. Liquidity and Speed

Centralized exchanges usually offer higher liquidity and faster trades. Decentralized exchanges can experience lower liquidity, which may cause delays or slippage especially for smaller tokens.

4. Fees

Centralized exchanges charge trading and withdrawal fees, often predictable but decentralized exchanges rely on blockchain network fees, which can fluctuate based on network activity.

5. KYC and Compliance

Centralized exchange enforces KYC and AML rules, which increases compliance but reduces privacy. Decentralized exchanges generally do not require KYC, allowing users to trade without revealing personal information.

6. Risk Exposure

CEXs are targets for hacks due to centralized custody. DEXs reduce this risk but are vulnerable to smart contract flaws or malicious projects.

7. Supported Assets

Centralized exchanges typically list popular cryptocurrencies and maintain strict listing criteria, and stable selection. Decentralized exchanges provide access to a wider variety of tokens, including new and niche projects.

8. Trading Features

Centralized exchanges provide advanced options like margin, futures, staking, and copy trading. Decentralized exchanges mainly focus on spot trading and liquidity pools and automated market making, with fewer advanced options.

Centralized Exchanges vs Decentralized Exchanges: Which Should You Choose?

Choosing between a centralized and decentralized exchange depends on what you value most as a trader. If convenience, high liquidity, advanced trading features, and responsive customer support matter to you, a centralized exchange is the more suitable option. CEXs are beginner-friendly, fast, and structured, making them ideal for users who prefer a guided trading experience without managing private keys themselves.

If your priorities lean toward control, privacy, and autonomy, a decentralized exchange may fit better. DEXs let you retain full ownership of your assets, trade anonymously, and interact directly with smart contracts. They appeal to users who want transparency, independence, or access to a wider range of tokens not listed on centralized platforms.

In reality, many traders use both. Centralized exchanges offer stability and efficient execution for large trades, while decentralized exchanges provide flexibility, privacy, and exposure to emerging projects. Understanding what each platform does best allows you to build a trading approach that aligns with your goals, risk tolerance, and experience level.

Frequently Asked Questions About Centralized vs Decentralized Exchange

1. Which type of exchange is better for beginners?

Centralized exchanges are better for beginners. They offer intuitive interfaces, and simplified processes, making it easier to start trading without technical knowledge.

2. Why do centralized exchanges require KYC?

KYC (Know Your Customer) is required to comply with financial regulations and prevent money laundering, fraud, and other illegal activities.

3. Do decentralized exchanges charge trading fees?

Yes, DEXs charge fees in the form of blockchain network (gas) fees for executing trades. These fees vary depending on network congestion.

4. Are DEX transactions anonymous?

Mostly yes. Decentralized exchanges don’t require KYC, so trades can be made without revealing personal information, though blockchain transactions are still publicly recorded.

5. Do I need a crypto wallet to use a DEX?

Yes. Since decentralized exchanges are non-custodial, you need a compatible wallet to hold your funds and interact with the platform.

Conclusion

Choosing between centralized and decentralized exchanges comes down to your priorities as a trader. Centralized exchanges offer convenience, liquidity, and support, making them ideal for beginners or active traders who value speed and ease of use. Decentralized exchanges, on the other hand, provide full control of funds, privacy, and access to a wider range of tokens, appealing to advanced users and DeFi participants.

Many traders find that using both types strategically provides the best of both worlds, speed and stability from centralized platforms, combined with autonomy and flexibility from decentralized ones. Understanding the differences and aligning them with your goals ensures safer, smarter, and more efficient trading.

Last updated on December 8, 2025