Table of Contents

Nigeria is one of the biggest crypto markets in the world, with up to 10 million crypto traders in the country. This is because crypto trading is one of the ways to make money online in Nigeria. So, with the value gap between the Nigeria naira and the US dollar, many Nigerians are now using USDT for everything—getting paid for freelance work, sending money abroad, and even saving their earnings.

Transferring USDT to your bank account isn’t rocket science. However, many people still struggle to do so. If you have USDT, you might want to transfer it to your bank account for different reasons. Maybe you need to settle an urgent bill or naira for a transaction.

Whatever the reason you want to transfer USDT to your bank, this article will guide you through a step-by-step process for sending USDT to your bank account in Nigeria.

Why Do People Transfer USDT To Bank Account?

1. Bills and daily expenses

Despite the rise in crypto adoption, most everyday transactions are still carried out with traditional fiat. As a result, people need to transfer their USDT to their bank account to pay bills like electricity, rent, transport, and food.

2. Big purchases

Many people store their wealth in USDT to avoid inflation and Naira’s unstable value. But when they have to transfer their USDT to their bank account to make big purchases, like when they want a landed property.

3. Cashing out profits

People also transfer their USDT to bank accounts after they’ve made profits from cryptocurrency investments. This allows them to access funds using traditional fiat currency for personal or business needs.

Where To Convert Your USDT to Cash

1. Crypto Exchanges

Crypto exchanges are one of the most popular places where you can convert your USDT to cash. Examples of crypto exchanges are Binance, Kraken, and Coinbase.

2. Peer-to-Peer (P2P) Platforms

2. There are many P2P platforms, such as LocalBitcoins and Paxful, that connect buyers and sellers directly. You can sell your USDT to individuals or businesses on these platforms, often with more flexible payment options.

3. Over-the-Counter (OTC) Platforms

You can also sell your USDT on OTC platforms, enabling you to directly convert your token to cash. The price here is fixed, which you can sell your token as fast as possible.

Best Place To Convert Your USDT To Cash – Prestmit

You need to transfer or sell USDT on a digital trading platform to be able to withdraw it as cash to your bank account. With so many platforms out there, it can be difficult to know which is legit or the best for you.

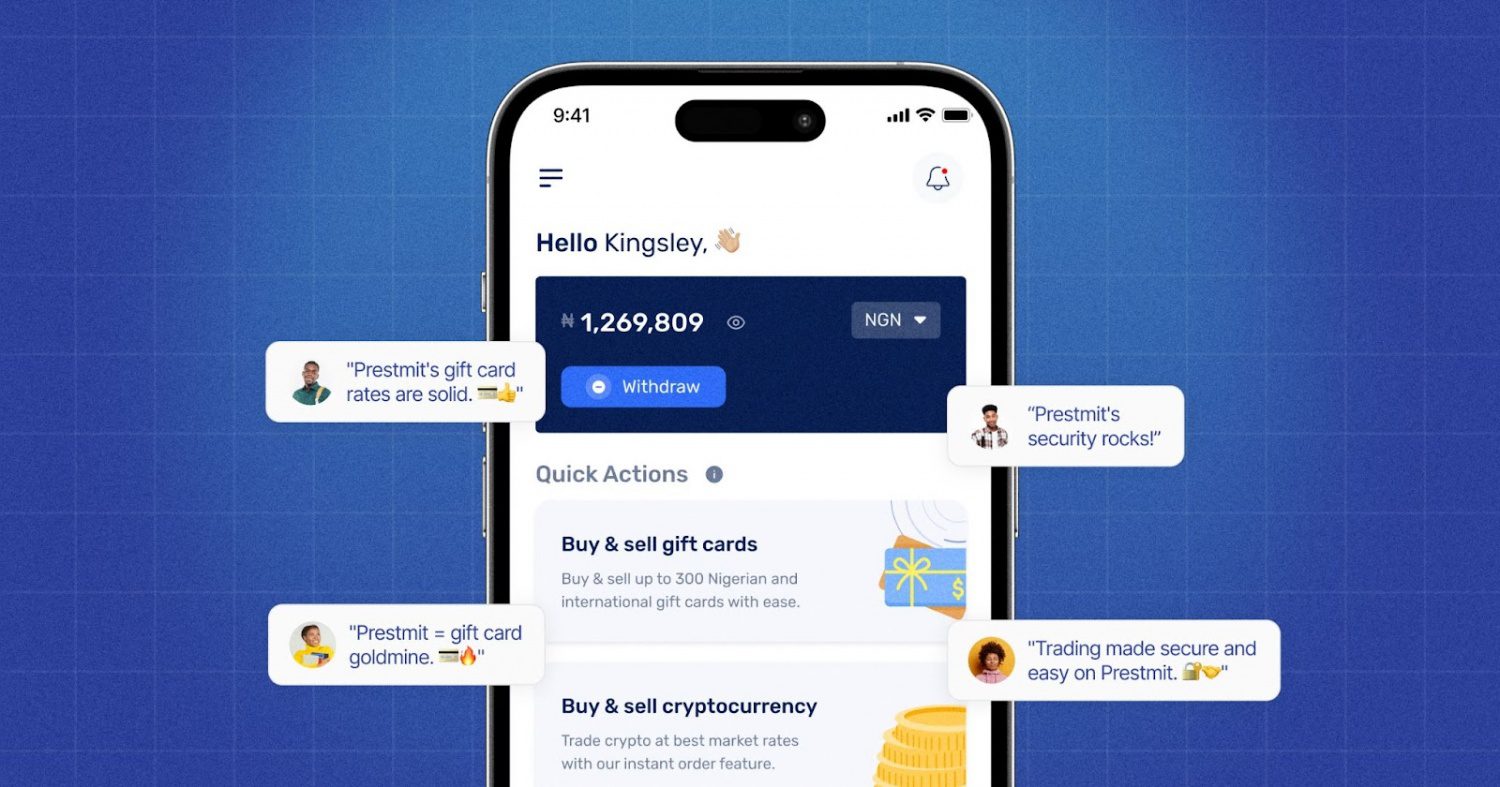

Prestmit is one of Nigeria’s leading platforms where you can easily carry out your stablecoin conversion. Prestmit offers a wide range of services, including buying and selling gift cards, bills payment, and more.

Features of Prestmit For Your USDT To Cash Conversion

1. Best Rates

Presmit offers one of the best rates for converting your USDT to cash. You don’t have to be worried about paying a large percentage of your USDT as conversion fees. Prestmit also allows you to convert your USDT to either Naira or Cedis. So, whether you’re in Nigeria or Ghana, you can always count on Prestmit.

2. Instant Payouts

Say goodbye to unnecessary delays when you trade your USDT for cash on Prestmit. It offers instant payment, and you’ll get your cash immediately when your transaction is confirmed.

3. 24/7 Customer Support

Whether you have a question to ask or an issue to resolve, Prestmit’s customer service team is always available to attend to your needs.

4. Security

Many people fear getting scammed or ripped off. However, Prestmit offers both 2FA and biometric authentication to protect your funds and data from third parties.

How To Convert Your USDT to Cash On Prestmit

Here’s how to register on Prestmit and convert your USDT to cash:

- Download the Prestmit app on the Google Play Store or Apple Store.

- Create a Prestmit account and log in.

- Click “Crypto” and choose “Sell USDT.”

- Generate a “Prestmit USDT Wallet” address and follow the prompts.

- Your USDT will be converted to cash immediately after the confirmation of the transaction, which you can withdraw into your Prestmit Naira wallet or bank account.

How To Withdraw From Prestmit Wallet To Your Bank Account

- Click on “Withdraw” on the Presmit app homepage

- Enter the amount you wish to withdraw from your wallet balance

- Click “Select Bank Account” and choose from your list of available accounts. If you haven’t previously added an account, click “Add New Account” to add a new one. Enter your account number and select your bank from the options list, then click “Save Bank Account.”

- Click on “Withdraw” and enter your PIN to confirm the withdrawal.

Security Tips For Converting Your USDT to Cash

1. Only Use the Real Prestmit App/Site

Always use the official Prestmit website or download the official app from the Google Play Store or Apple Store. If someone messages you claiming to be from Prestmit support, ignore them – Prestmit’s support won’t DM you first.

2. Enable 2FA

Turn on two-factor authentication (2FA) on your Prestmit account to prevent it from unauthorized access. This also helps to keep funds and your transactions on the platform safe.

3. Keep Your Account Information Private

Never share your account information with anyone. Do not share it with “support” or a “verification agent.” And when sending USDT, double-check the address because some malware can change what you copy-paste.

FAQs on How to Withdraw USDT to Your Nigerian Bank Account

How can I withdraw USDT to my Nigerian bank account?

You need to use a platform that supports USDT withdrawal. Transfer the amount you want to withdraw from your wallet to the platform if you use a different wallet. Then, follow the steps in this article to withdraw or transfer your Tether to your bank account seamlessly.

Can I transfer Tether from one exchange to another?

Yes, you can transfer Tether from one exchange to another. All you need to do is get the receiver exchange’s wallet address. On the sender exchange, go to the withdrawal section and enter your account’s wallet address on the receiver exchange.

Can I Convert My USDT to Cash?

The major appeal of Tether USDt is that it allows anyone to switch between digital currencies and fiat money. So, yes, you can convert your USDT to cash.

Which exchange supports the withdrawal of USDT to a bank account?

Since a myriad of platforms trades in USDT, many of the same enable users to withdraw the token to a bank account. Examples are Binance, Coinbase, Kraken, Prestmit, Paxful, etc.

Conclusion

USDT offers a secure and convenient way to store your money if you’re worried about inflation or Naira depreciation. If at any time you want to convert your USDT to cash, you can easily do that on Prestmit. The platform offers the best conversion rates and instant payouts for all your USDT to cash transactions.

Last updated on March 28, 2025