Online platforms have increasingly become a hotbed for hackers to perpetrate scams to steal unsuspecting users’ funds. This does not exclude the popular payment app Venmo, which malicious entities have constantly targeted. From social engineering attacks to malware, scammers have devised various ways to target Venmo users. Hence, you need to know the common Venmo scams to watch out for.

1. Phishing

Phishing is a popular strategy scammers employ to attack victims in this digital age, as it is popular with crypto scams, and Venmo is not an exception. Hackers can impersonate Venmo to email you requesting to update your personal details or payment information.

When you click the link in the email you received, you will be redirected to a website that looks like the original Venmo login page, which the hacker operates in the actual sense. The hacker will be able to see your login details when you enter the information, giving them the opportunity to take control of your account.

2. Identity Theft

Identity theft is another common Venmo scam, as a scammer could steal your friend’s Venmo account and demand to borrow money from you. You may later find out that your friend never requested money after you’ve sent it to these bad actors.

Malicious entities usually steal people’s identities and use their vulnerability to get cash and sensitive information from other victims. For instance, hackers can wreak havoc when they access credit card information or other vital details about you.

3. Romance Scams

Venmo romance scams are similar to crypto romance scams as they often start with the scammer contacting their victim through social media platforms. Scammers build romantic relationships with their potential victims by using fake photos while trying to sound convincing and earn trust.

Once the victim has been made to believe their false identity, the scammer pretends to be in some trouble (mostly financial issues). They ask the victim to send money via Venmo with the promise to pay it back in the future.

The scammer immediately moves the money from their Venmo account to another account once they receive the funds. This is followed by the scammer cutting off contact with their victim.

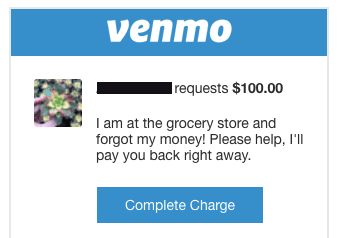

4. The ‘Accidental’ Money Transfer

Scammers can send money to you using a stolen credit/debit card and contact you with the claim that it was an accidental transfer. You will be requested to send the money back to your Venmo account.

Venmo can take back money transferred into your Venmo account upon discovering that a transaction was made from a stolen card. But the scammer keeps the money you transferred to them. This put you at a great loss.

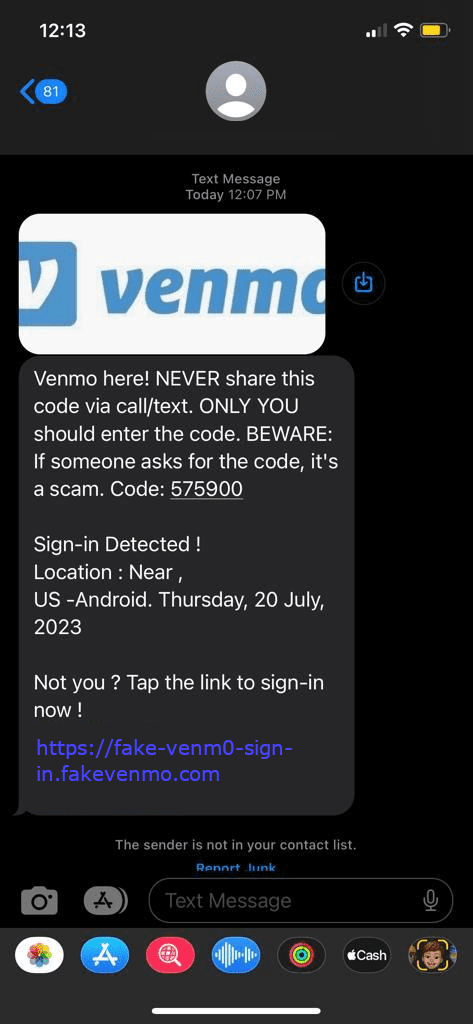

5. Smishing

Smishing is almost similar to phishing, but SMS text messages are used in this instance instead of emails. Here, a scammer can send you an SMS to trick you into exposing your Venmo login details. The message can have a link to infect your device with spyware such that scammers can monitor your device to steal your login details when you use Venmo.

How To Stay Safe As A Venmo User

1. Be Wary Of Strangers Contacting You

It would help if you were hesitant when someone you don’t know contacts you to follow links or URLs in emails or SMS. It should be noted that the entity contacting you could still be a scammer, even if they seem to know your personal and financial details. This is because they might have gotten the information due to identity theft or phishing.

2. Don’t Click Link In Your Email Or SMS

It will be a good and safe decision to not engage with a message containing a link. Even if the email looks like it came from Venmo, there is the possibility that a scammer is trying to act/sound convincing.

Therefore, it is essential to contact Venmo customer service when you receive a suspicious message. This is to keep you safe from falling victim to scammers.

3. Avoid Using Venmo To Receive Payment For Products And Services

You may need to use a credit card for your bank account to receive payment for products or services rather than using Venmo. This is because you can use Venmo without a bank account, which is an opportunity that scammers can leverage.

While Venmo is a relatively safe service, it can be difficult to track down scammers who use the platform after they have hacked unsuspecting user’s accounts.

Frequently Asked Questions (FAQs) About Common Venmo Scams

Can Scammers Steal My Fund On Venmo?

You can be vulnerable to identity theft and fraud if you do not take precautionary measures to keep safe when using Venmo. Therefore, you must be wary of clicking links in your email or SMS and use enhanced security features like two-factor authentication (2FA) to prevent unauthorized access to your account.

Will Venmo Refund My Money If Scammed?

The answer is mostly No. This is because there is no way to cancel a Venmo payment after it has been sent. It should also be noted that we don’t usually get involved with financial disputes between users.

Can I Cancel A Venmo Payment I Sent To The Wrong Person?

You can not cancel or reverse a Venmo payment you have made to a recipient. So, the only option to remedy this accidental transfer is to ask them to return the money to you. Therefore, be careful of the transactions you make on your Venmo account.

Conclusion

Scams continue to increase across online platforms like Venmo as hackers are exploiting vulnerabilities to steal users’ funds. Hackers use identity theft, phishing, and other Venmo scams highlighted in this article to rip people off big time.

Therefore, it is essential to be cautious when using a Venmo account as you need to take care of your account as you will do to your bank account.