Table of Contents

eToro is an online trading platform that enables users to trade various asset classes such as cryptocurrencies, stocks, commodities, and more. But one of the key features of eToro is its “Copy Trading” function that allows users to automatically copy the traders of other successful traders on the platform. So this eToro Copy Trading review can be useful for both beginner traders who are new to trading or advanced traders who want to diversify their portfolios.

An Overview Of eToro Copy Trading?

Copy Trading is one of the methods of joint investment in the financial markets that is gathering momentum. It enables less experienced users to subscribe to the trading signals of professional traders. Once you subscribe to a trader, you can copy every trades and orders on the trading account of this trader at a specific ratio.

Notably, eToro has one of the most advanced and largest social trading networks with Copy Trading at the fore of its functions, as this can help you to trade Bitcoin on eToro. The platform is known for its beneficial trading conditions, low entry threshold, simplicity, and excellent functionality.

Pros And Cons Of eToro Copy Trading

Pros:

- It provides opportunity for beginner traders to earn at the same level as top traders on the platform.

- It can help investors to diversify their portfolios.

- Minimum investment is $200.

- No additional commission.

Cons:

- It can be risky if the trader you are copying is making risky trades.

- High returns of traders in the past do not guarantee the same outcome in the future.

- Requires careful research and consideration before getting started.

Features Of eToro Copy Trading Platform

1. Feeds Section

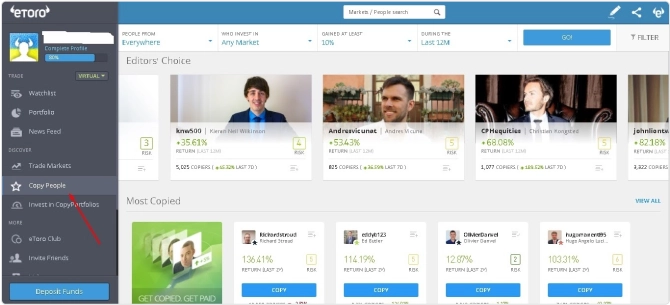

The main page of eToro features profiles of the most successful traders selected by the editors and algorithms of eToro based on different indicators. These are strategy, number of copiers, return rate, and risk factor.

Every trader has a profile with a real photo that when you click on it, you can see the first and the last name of the trader, including view posts. Traders often share market news and users can also like, share, and comment on post, just like the traditional social networks.

2. eToro Trader Statistics

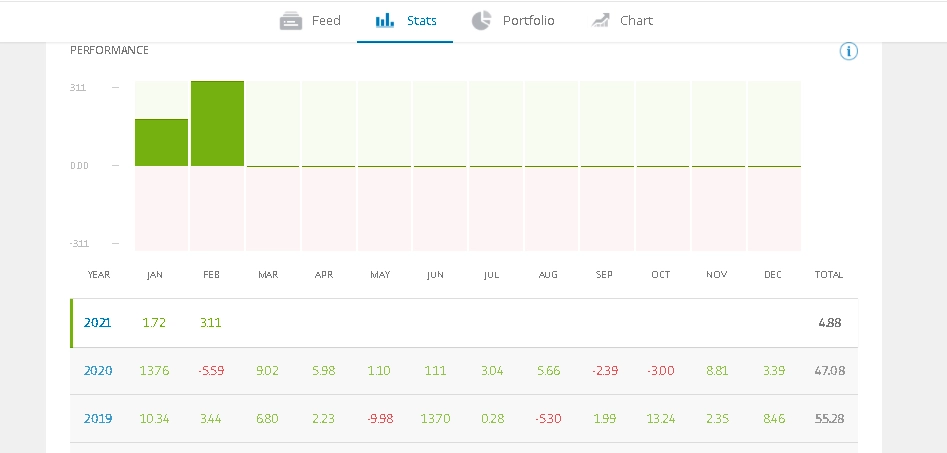

You can fully study a trader’s performance for a period of one month or even years in the Stats section. This also include keeping tabs on returns and maximum losses per day, month, and year.

This section also allows you to view distribution of assets by markets and the latest trades of the trader, as well as the average number of profitable trades.

3. Trader’s Portfolio

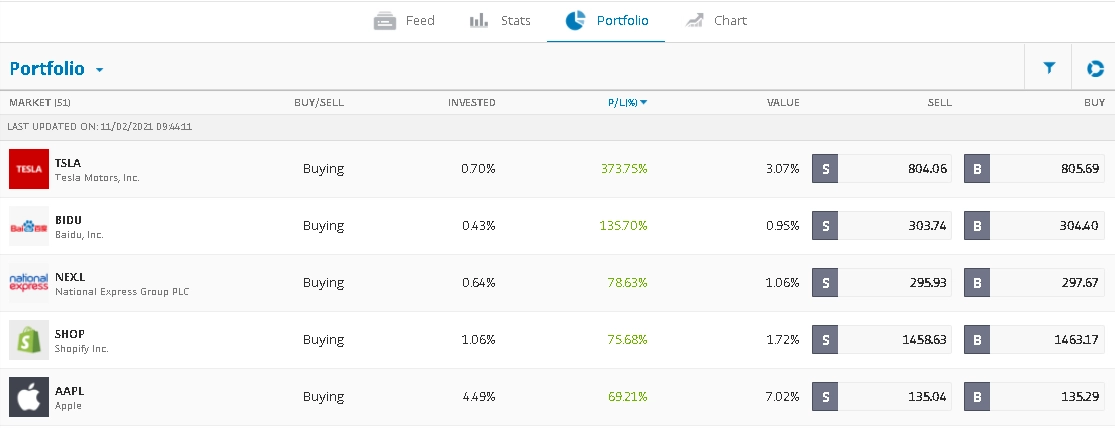

You can go to a Trader’s Portfolio section to monitor its composition, position (Long/Short) and current Profit/Loss percentage. You can also examine the portfolio composition as a chart to give you an overview of the portfolio performance.

4. Chart Section

The Chart Section allows you to view profitability dynamics of the trader. It gives the knowledge of how much you would have earned if you copied the trader at a specific time.

However, this section is somehow redundant as it is more of advertising. This is hinges on the fact that the results of the trader in the past do not guarantee the same outcome in the future.

How To Find The Right Trader To Copy On eToro

There are over 100,000 verified trader on eToro to copy. So this may pose difficulty in choosing the right trader to copy. As such, you can find the trader using two (2) different ways:

1. Selection Of Traders By Following eToro’s Recommendation

You can follow eToro’s recommendation as the broker provides review for the profiles of the most successful traders, which have passed the selection based on criteria such as return rate, strategy, risk score, and number of copiers.

This is considered the preferred option for beginner traders as you just need to select your favorite trader for copying trades on eToro.

2. Choose Traders On eToro Using Filters

eToro enables users to independently set the criteria of searching for traders to copy through the system of filters, which is featured in the upper menu on the “Copying People” page.

How To Start Copying Trades On eToro

Here are the steps to start copy trading on the platform:

- Visit the official eToro website and log into your account.

- Click “Discover” and choose “Popular Investors” to see the list of the popular traders on eToro.

- Click the profile of your preferred of your preferred trader to copy and view information about them.

- Click “Copy” in the profiles of your selected trader and follow the prompts to set up your copy trading account.

- You can view the results in your eToro Portfolio tab. You can also use this tab to stop copying, add or reduce the amount for copying, set additional risk management criteria.

Frequently Asked Questions (FAQs) About eToro Copy Trading Review

Is eToro Copy Trading Safe?

eToro is considered a reliable broker as it holds three (3) licenses from top regulators. These are the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

How Much Does eToro Copy Trading Cost?

You (copier) only pay the broker’s commission, which according to the eToro website comes from the spread of the trades, which are copied on your account. But $200 is the minimum account required to copy a trader.

Can I Make Money By Copy Trading On eToro?

Yes, you can make money from copy trading if the traders you copy also make money. But there are no guarantees. Copy trading is essentially copying the trades of a trader on your eToro account. So if the trader makes profit, you will also make a profit. If the trader loses money on the trade, you will also lose money.

Conclusion

eToro copy trading is a feature that beginner and advanced traders can leverage to have a profitable trading, as it helps you to mimic the trades of popular and successful traders on the platform.

However, it is essential to note that there is guarantee for maximum returns on your trade. This is because whether you make profits or loses money depends on the trader you copy. Therefore, it is imperative to use the money you can easily risk.