Table of Contents

About 32% of Nigerians own or trade crypto with over $50 billion worth of crypto transactions recorded within the last two years alone. However, owning cryptocurrency is one thing, and turning it into usable cash is a different thing entirely. I’ve been left stranded several times while looking for a legit platform to convert my crypto to cash. At one point I almost fell into the hands of scammers due to my desperation as I needed cash to sort urgent bills and I didn’t want to sell my crypto, I just wanted to convert it to Naira.

I almost gave up until I came across Breet. But many Nigerians are still cautious about Breet, and rightfully so because no one wants to lose their crypto assets to scammers. Hence, this article explains what Breet is, assesses its legitimacy in Nigeria, its features and services, etc.

What is Breet?

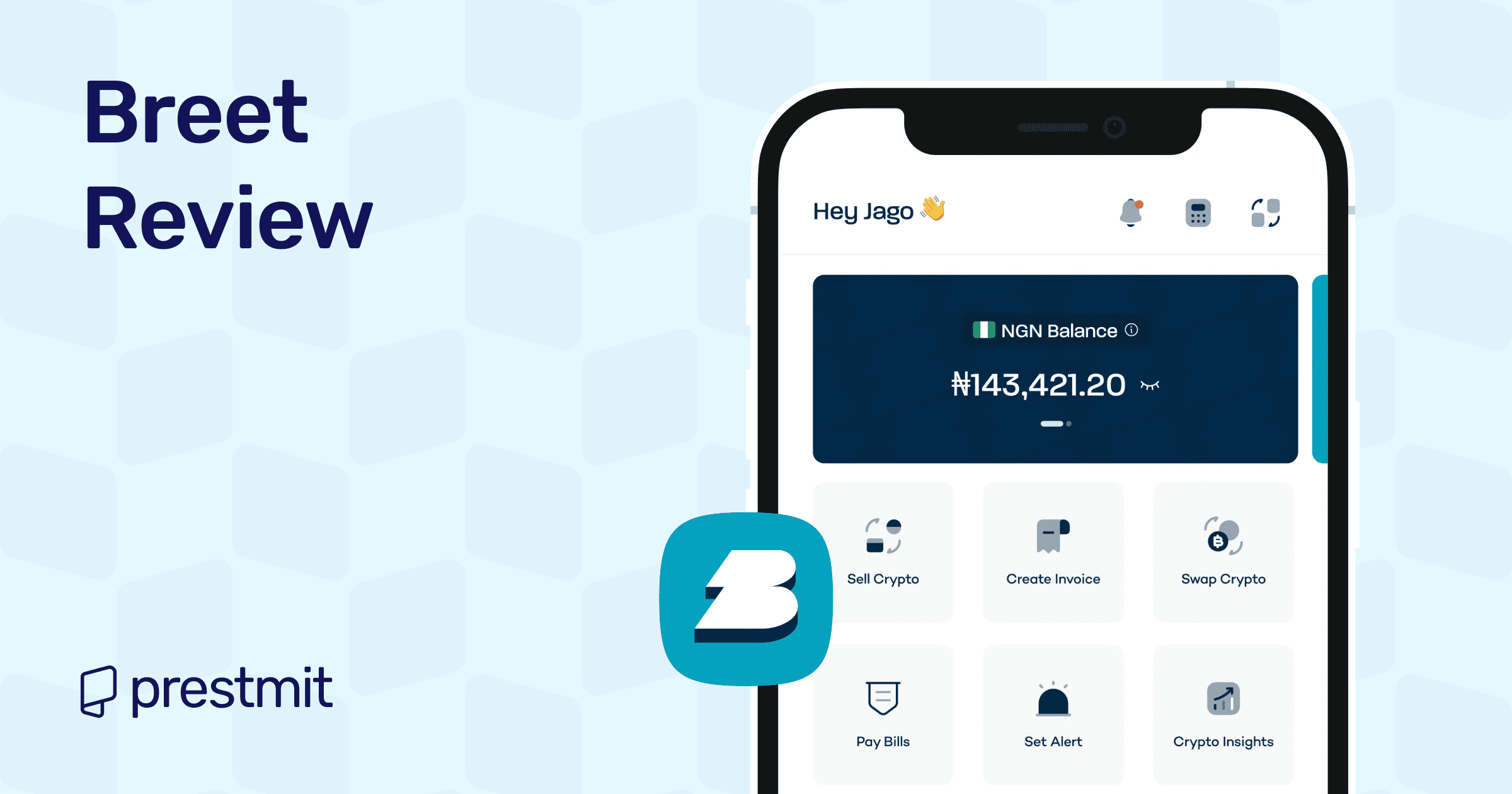

Breet is a crypto-to-fiat platform owned by Inbreetic Technologies Limited. The platform is designed to make cryptocurrency usable in real life for Nigerians (and users in certain African markets). Unlike a typical crypto exchange where people buy and sell crypto via order books, Breet specializes in converting crypto assets into local currency (like Naira) or giving tools for businesses and freelancers to receive crypto payments and automatically get paid in local cash.

Users are given wallet addresses for supported cryptocurrencies after creating a Breet account. Any crypto sent to that address can be converted instantly into Naira or other local currency. Breet also provides in-app swapping between tokens, invoice generation for businesses, and bill-payment functions for everyday expenses.

Is Breet Legit?

Yes, Breet is a legitimate, operating platform in Nigeria. Breet is available for download on major app stores (Android and iOS), with public user reviews from Nigerians. In addition, independent review platforms list Breet with solid user scores, and many users praise its ease of converting crypto to cash without the hassle of peer-to-peer trading.

Still, legitimate does not mean risk-free. No online platform handling value can guarantee 100% safety or a flawless user experience. Hence, users must be cautious of crypto’s volatility, potential blockchain delays, and evolving regulations.

Core Features and Services of Breet

1. Instant crypto-to-cash conversion

Breet’s main service is converting crypto into local currency. Once a user sends crypto to a Breet wallet address, the platform automatically converts it into Naira (or other supported currencies) after blockchain confirmation. The converted funds are then credited to the user’s Breet balance and they can be withdrawn immediately.

2. Supports many cryptocurrencies and token swaps

The app supports a wide variety of tokens, including major ones like Bitcoin, Ethereum, stablecoins, and several others. Users can also swap cryptocurrencies inside the Breet wallet before cashing out.

3. Crypto invoicing for businesses and freelancers

Users such as freelancers, small businesses, or service providers can generate invoice links, send them to clients globally, and receive payment in crypto. Once the client pays, Breet automatically converts the crypto to local currency and settles it to the user’s bank account. This removes the need to handle crypto volatility, making it easier for African professionals to get paid in Naira while offering crypto as a payment option to global clients.

4. Bill payments and daily utility payments using crypto value

Converted crypto value can be used to pay bills like airtime, data subscriptions, electricity, cable, and more directly from the Breet app. This bridges the gap between digital assets and daily living expenses, turning crypto from an investment into a practical financial tool.

5. Automated settlement

Breet offers auto-settlement options. That means once crypto is received and the conversion completed, funds can be automatically sent to your linked bank account without manual withdrawal.

User Experience and Interface of the Breet Platform

Breet has a simple, intuitive interface that makes usage seamless even for those new to crypto.

Signing up on Breet is easy. All you need to do is register, verify your email (and identity if needed), and then receive crypto wallet addresses. Many elements of the process such as sending crypto, converting, and withdrawing are automated. The interface has clear calls to action such as “Sell Crypto,” “Generate Invoice,” or “Pay Bills,” which help people who are not tech-savvy navigate without confusion.

Transactions are usually completed within minutes and this makes Breet significantly faster and less risky than using peer-to-peer platforms where you depend on another user to pay. However, there could be occasional delays or slower support when there are disputes or heavy traffic.

Security, Regulation, and Trust

Breet uses common security standards such as encryption, fraud protection, and compliance measures to protect users’ data and funds. Regulation in Nigeria around cryptocurrency has been evolving. Many crypto exchanges struggled with fiat-on/off ramps due to the restriction placed by the Central Bank of Nigeria on banks facilitating crypto transactions.

However, more recent regulatory guidance allows banks to maintain accounts for licensed virtual asset service providers under defined rules. That regulatory clarity makes services like Breet more viable as long as they comply with KYC (know your customer), AML (anti-money laundering), and bank settlement requirements.

Strengths of Using Breet

1. Fast cash-outs

One of the biggest advantages Breet offers is speed. The elimination of peer-to-peer buyer dependency, escrow waiting times or uncertain manual payments means you get your cash quickly with transactions usually taking just minutes on average.

2. Ease of use for non-technical users

There are no order books, no confusing limit orders, no complicated trading. You just send crypto, and the platform handles conversion and payout. That simplicity makes it accessible to people who are new to crypto or prefer straightforward financial tools.

3. Practical for freelancers and businesses dealing with international clients

The crypto-invoice tool is powerful. It allows businesses and freelancers to receive crypto payment and receive Naira. This solves a core problem for Nigerian professionals who work with overseas clients but need local cash.

4. Local-currency payouts and integrated utility payments

Breet settles in Naira so users get local-currency value rather than holding foreign stablecoins or digital currencies. The added convenience of paying for airtime, data, cable, electricity, etc., through the app turns crypto from an asset into a real-life tool which comes in handy for many daily expenses.

Limitations of Breet

1. One-way crypto-to-fiat system

Breet does not support buying crypto with Naira. Its primary function is conversion from crypto to cash, fiat settlement, and utility/billing integrations. Breet is not built for full exchange functionality, trading pairs, or margin trading.

2. Fees and rate spreads may vary with market conditions

Like any conversion service, Breet charges fees or applies rate spreads. The fees and exchange rates depend on the coin, the amount being sold, and market conditions. Those fees could be significant for large withdrawals or bulk conversions.

3. Customer support and dispute resolution can be slow

Given that crypto-to-cash involves blockchain confirmations, banking settlement, and sometimes unpredictable network or bank delays, resolving issues may take time. For large amounts, that can be stressful.

4. Regulatory risks and banking dependencies

While current regulation allows virtual asset service providers to operate with bank support, regulatory frameworks in Nigeria remain fluid. Changes in banking policy, central bank rules, or compliance requirements could affect how smoothly withdrawals and settlements work. Users should stay informed and avoid assuming that current processes will always stay the same.

5. Not ideal for active traders

Breet’s simple conversion model may feel limiting if you are looking for features like limit orders, margin trading, charting tools, or frequent trading. It is designed for cash-out, invoicing and utility use not for full cryptocurrency trading.

Frequently Asked Questions (FAQs) on Breet Review

1. How fast is cash-out on Breet?

Cash-outs typically take a few minutes. Once crypto is sent to your Breet wallet address and confirmed on the blockchain, the platform converts it to Naira and credits your balance. Funds may arrive in your linked bank account shortly after if auto-settlement is enabled.

2. Can I buy crypto on Breet using my bank account?

No. Breet focuses on crypto-to-fiat conversion and does not support fiat-to-crypto purchases. If you want to buy crypto with Naira, you’ll need a different service or exchange.

3. Is my money and data safe on Breet?

Breet uses encryption, secure wallet addresses, and blockchain confirmations to protect users data and funds. While these are good, no online system is immune to risk. Always verify wallet addresses, keep transaction records, and enable any available security features.

4. Can businesses legally use Breet in Nigeria?

Yes, many freelancers and small businesses already use Breet’s crypto-invoice feature to accept global payments and get paid in Naira. The service relieves them from dealing with volatility or foreign exchange issues.

5. What happens if there’s a delay or issue with payment?

Contact support and provide transaction IDs and other necessary information if there is a dispute or unexpected delay.

Conclusion

Breet is a legitimate and practical crypto-to-cash service tailored for Nigerians. It offers a useful bridge between cryptocurrency holdings and everyday cash needs. The combination of crypto-to-fiat conversion, business invoicing, bill payments, and local-currency settlement makes it a valuable tool (specially for freelancers, small businesses, and anyone who wants to use crypto value without the complications of peer-to-peer trading).

However, Breet is a one-way system (crypto-in, cash-out), not a full trading exchange.If you are considering using Breet, treat it like any financial tool: start small, test with a small transaction, verify every detail carefully, and avoid treating it as a passive savings or investment account.