Table of Contents

Mutual funds and their impacts are gaining significant traction within the discourse of the capital market in Nigeria. This is owed to the growth this investment portfolio has recorded over the years, rising from N1.31 trillion in December 2021 to N2 trillion in 2023. So, given the potential of mutual funds in Nigeria, investors continue to tilt towards the investment because it provides a simple, low-cost way to invest while minimizing risk. In light of this, let’s explore how it works for investors.

What Are Mutual Funds?

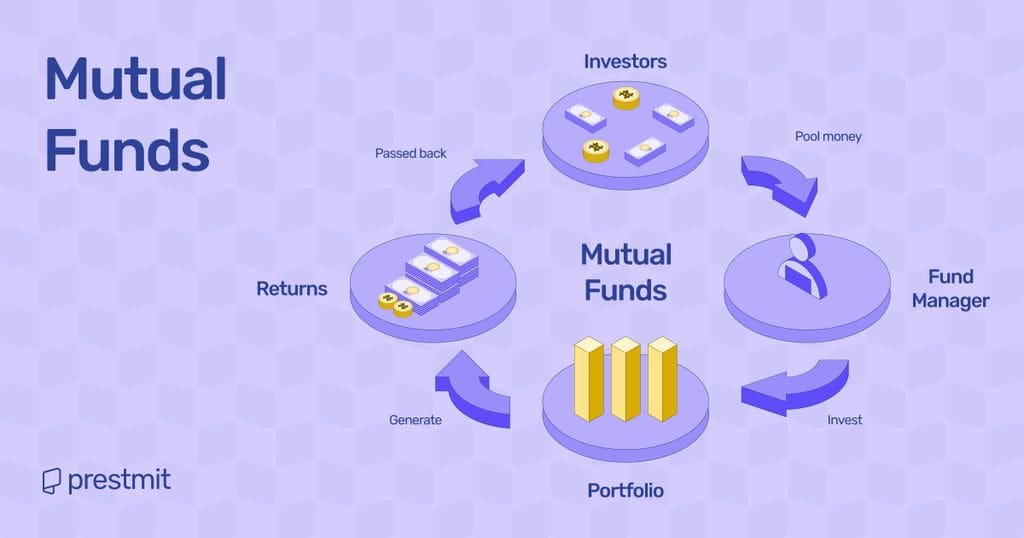

A mutual fund is a fund managed by professionals that pool money from many investors to invest in securities such as stocks, bonds, other assets, or some combination of these investments. The pooled funds are overseen by professionals known as fund managers, who are fully accredited by the Securities and Exchange Commission in Nigeria and ensure that investors earn returns.

How Mutual Funds Work

A mutual fund is a pooled investment vehicle – meaning that you and many other investors take your money and put it into one place. So, with the help of an investment or fund manager, the money is allocated to a collection of stocks, bonds, and other securities.

It is popular knowledge that you alone cannot own a single share of stocks in hundreds of companies or even thousands of bonds. But you can hold these securities by purchasing units of a mutual fund through fund managers.

Overall, mutual funds give small and big investors access to professionally managed portfolios of stocks, bonds, and other securities.

In practicable terms, you can relate how mutual funds work to cooking a jollof rice. If you use rice and other regular ingredients as your recipe, the rice might cook but without much taste. However, adding pepper, tomatoes, spices, and other ingredients to your cooking will make a delicious dish.

In a similar vein, mutual funds combine different investments to create a balanced “dish” of portfolios for your money. So, instead of putting all your funds into a stock or bond, a mutual mix of many investments helps to reduce the risk of losing everything.

Types Of Mutual Funds

1. Money Market Funds

Money market funds have relatively low risks. This is because they invest in a selected group of short-term, high-quality securities that the government and companies issue.

2. Equity Funds

Equity funds are also called stock funds that invest in business equities. Stock funds are really not the same as some equity funds, which are named according to the size of the company in which they are invested. This can be small-cap, mid-cap, large-cap or multi-cap equity funds.

In addition, other equity funds are named by investment approach such as income-oriented, growth-oriented, etc.

3. Bond Funds

Bond funds majorly invest in bonds. They endeavor to earn great returns but have higher risks than money market funds. The risks and returns of bond funds vary due to the large range of bonds.

4. Target Date Funds

Stocks, bonds, and other investments are all combined in target date funds. This blend changes over time, depending on the fund’s strategy. Target date funds are also called “Lifecycle funds,” created for people with given retirement dates.

5. Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) with an investment to replicate or follow the features of a financial market. This type of fund offers low operating costs, minimal portfolio turnover, and wide market exposure.

How To Invest In Mutual Funds In Nigeria

Here is a step-by-step guide to investing in mutual funds:

Step 1: Choose A Mutual Fund Provider

Research and choose a reputable and reliable mutual fund provider. Many banks and investment companies in Nigeria offer the funds. So you just need to look for the best one that provides easy access to support.

Examples include AXA Mansard, ARM Investment Managers, Stanbic IBTC Asset Management Ltd, etc.

Step 2: Decide On Your Investment Goals

You need to consider and reconsider your investment goals. Think and provide answers to questions such as “Are you investing for regular income, short-term profits, or long-term wealth?” As such, your goal will help you decide and choose the right type of mutual fund.

Step 3: Open A Mutual Fund Account

It is simple to open a mutual fund account. To get started, visit your preferred provider, either online or offline, in their offices, complete the required forms, and submit the necessary documents. In many instances, providers will request a valid means of identification and other personal information to create your account.

Step 4: Fund Your Account

You will need to fund your account after set up. Decide your preferred amount, although most funds have a minimum entry amount.

Step 5: Monitor Your Investment

You can check your investment regularly to track its performance. Some providers give you access to online statements, enabling you to track growth and make adjustments as required.

Benefits Of Investing In Mutual Funds

1. Cost-Efficiency

Most mutual funds are cheap and beginner-friendly, although some are expensive. Compared to stocks or bonds, the funds have a small entry amount for you to start investing. It also gives everyone in the fund a buying power you may not get individually.

2. Diversified Portfolio

It is always a rule of thumb within the investment discourse to invest in multiple assets to reduce the risk of loss. But while diversifying your portfolio can be a trick, especially for beginner investors, it is often suggested that they invest in mutual funds, which come diversified.

3. Liquidity

Mutual funds are liquid, meaning that you can sell your funds unit any time. The returns may be low when the fund is experiencing a loss but are less volatile than crypto assets like Bitcoin and Ethereum.

Risks Of Mutual Fund Investment

1. Fund Manger’s Risk

The performance of any mutual fund is a function of the manager’s experience, knowledge, and investment techniques. If these factors are lacking, there may be a negative impact on the fund’s performance and unit holders.

2. Market Risk

Factors like economic and market conditions, economic instability, currency and interest rate fluctuations can reduce the prices of or income generated by companies’ assets.

3. Over-Diversification

Let’s reiterate that diversification is one of the benefits of a mutual fund. However, there can be over-diversification, which would increase the operational costs of a fund and diminish the benefits of diversification.

Frequently Asked Questions (FAQs) About Mutual Funds

How Much Can Invest In A Mutual Fund In Nigeria?

Mutual funds usually have an investment band, depending on the type of the fund. While some can be as low as a minimum of N5,000, some can be N100,000 or even N1 million.

Are Mutual Funds Profitable?

Like other forms of investment, mutual funds have rewards and risks that determine whether they make or lose money. You can know how profitable a mutual fund is or can be by considering the history of the fund managers. The managers have experience running the funds, and you can look at their track record.

Are My Returns Tax-Free?

The gains made from investing in mutual funds are not tax-free. You will be taxed on the profit by the relevant tax authority.

How Do Fund Managers Make Money?

Fund managers make money from fees they charge you for helping to invest your money. They charge you fees when you invest and also charge a fee when they make a profit on your investment. Managers can charge fees between 2% – 5% of the value of the investment.

Conclusion

A mutual fund is considered one of the easiest ways to invest without losing your funds, and this is evident in the number of investors attracted to the landscape. But while there are many fund managers in Nigeria, it is essential to research and choose the one that aligns with your financial goals.