Table of Contents

Have you ever accidentally purchased more airtime than you intended, maybe by adding an extra zero, only to realize too late that you’ve had excess airtime? If so, I’m sure you wondered whether converting the excess amount to cash is possible, right?

Well, in this comprehensive AirtimeFlip review, we will discover if this popular airtime-to-cash platform is a reliable solution or just another scam in a sea of many.

Stick around as we dive into all the nitty-gritty details and uncover everything you need to know about AirtimeFlip.

What Is AirtimeFlip?

AirtimeFlip Technology Limited is a company designed to help users convert airtime to cash in Nigeria. It aims to help users get affordable data rates and a convenient way to pay their bills, Airtime top-ups and data top-ups.

Its main objective is to offer affordable data rates while providing a convenient way to pay bills and top up airtime and data.

The platform claims to offer the lowest rates in the country while ensuring top-notch security, making transactions both fast and secure. Its services are available 24/7, and its airtime-to-cash transactions take about 3-15 minutes to process.

Finally, AirtimeFlip has a mobile app available on the Google Play Store and App Store. Its friendly user interface is well-designed to ensure your needs are met instantly.

You can either carry out your transactions directly on the platform via the web or the mobile app. Download the app from the Google Play Store or App Store, sign up, and confirm your details, and you’re good to go!

How Does AirtimeFlip Work?

AirtimeFlip is super easy to use – so simple that even a 10-year-old could navigate it from start to finish without any trouble!

Here’s a guide showing you a step-by-step process of how AirtimeFlip works.

- Download the AirtimeFlip app from the Google Play Store or App Store on your mobile device.

- Once installed, open the app and create an account.

- After creating your account, proceed to log in.

- Set up your 4-digit transaction PIN for secure transactions after logging in.

- Once in, go to your user profile and provide additional details, such as your NIN and BVN, to upgrade your KYC level and access all the services.

- Add a primary bank account to your bank settings.

- You are now ready to use the services available on the app!

Making and Verifying Transactions

If you want to make transactions on the AirtimeFlip app, say, for example, manually convert your airtime to cash, all you need is to do the following:

- Login

- Select network provider

- Input the phone number

- Input the amount into a sale

After these, you will be shown the rate to be deducted and the amount you will receive after the deduction.

Next, you click to proceed, input your 4-digit transaction PIN and the transaction will be processed. Other services like bet account funding and bill payments follow the same procedure.

Note: You can also log in to the web platform once you’ve created an account and utilize the same services as those on the app. However, using the app is much better as it provides a faster and more seamless experience.

Wallet Operations

Once you have registered on the AirtimeFlip platform, you are issued a wallet. With this wallet, you can receive funds from your credit card or bank account, send money to your bank account, and transfer funds to other AirtimeFlip users.

You will be charged a sum of 50 naira to withdraw funds from your AirtimeFlip wallet to your bank account. However, you can receive and transfer funds at absolutely no cost.

Note: You can only fund your AirtimeFlip wallet from your credit card or bank account when you upgrade your account by providing additional information about yourself, such as your NIN and BVN.

Features of AirtimeFlip

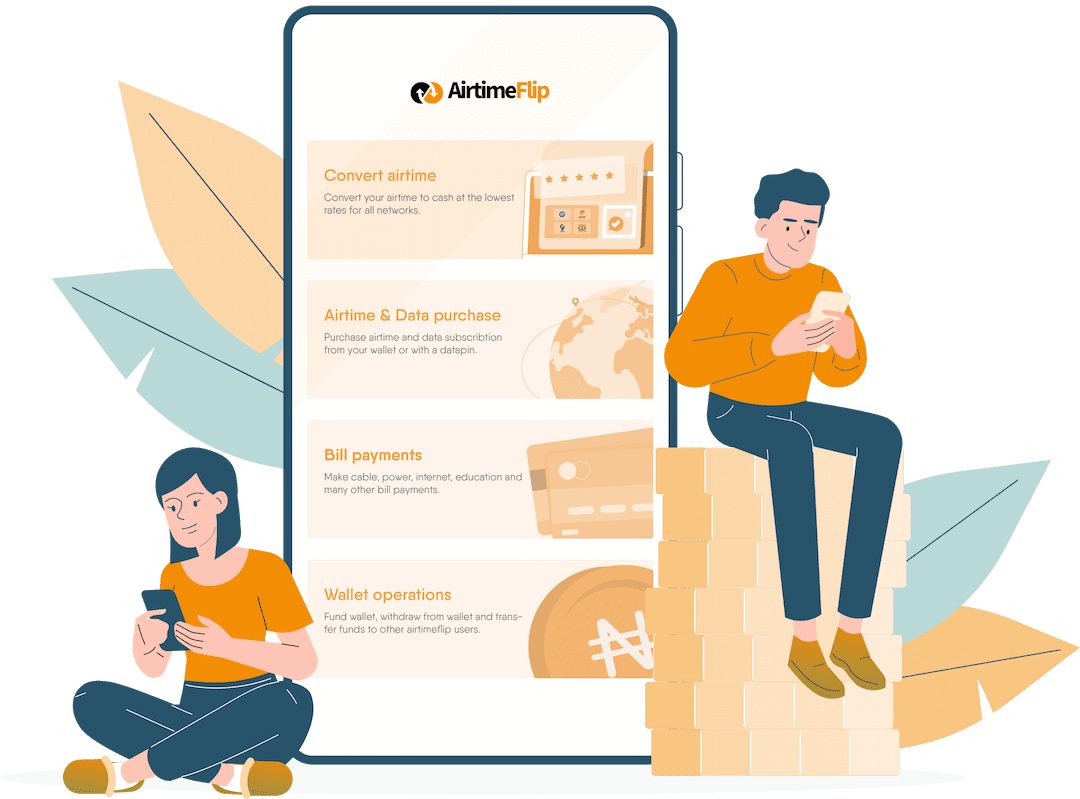

AirtimeFlip offers a range of features to provide a seamless and efficient experience. Here are some of the key features below:

- Airtime Conversion: Easily convert excess airtime from all major Nigerian networks into cash, providing a solution for unused airtime balances.

- Instant Airtime and Data Purchases: Quickly buy airtime and data bundles for all major networks directly through the platform, ensuring uninterrupted connectivity.

- Bill Payments: Conveniently pay various bills, such as electricity and cable subscriptions, all in one place, simplifying financial management.

- Betting Account Funding: You can fund your betting accounts directly from the platform, streamlining the process for users who engage in online betting.

- Secure and User-Friendly Interface: The platform is built with robust security measures and an intuitive design, ensuring a safe and hassle-free user experience.

- Competitive Rates: AirtimeFlip offers some of the best rates in the industry, maximizing the value users receive from their transactions.

- 24/7 Availability: The service operates around the clock, allowing users to perform transactions conveniently without time restrictions.

- Responsive Customer Support: A dedicated support team can assist with inquiries or issues, enhancing user satisfaction and trust.

Latest Updates and Benefits

Beyond its core features, AirtimeFlip has introduced new updates and benefits to improve user experience and stay ahead in an increasingly competitive market. Here are some of the latest additions:

- International Airtime and Data: You can now buy international airtime and data for your loved ones abroad at mind-blowing rates.

- E-Sim: You can easily purchase an eSIM and have it activated on quickly on your device.

- Gift Cards: You can now purchase gift cards from different countries in just a few clicks.

These features collectively make AirtimeFlip a comprehensive solution for efficiently managing airtime, data, and bill payments.

Rates and Charges

As earlier mentioned, AirtimeFlip claims to have the lowest rates in the country. However, when we tried out the platform, we discovered that it charges a 30% rate to manually convert airtime to cash and 50 naira on all withdrawals from your wallet to your bank account.

For example, if you intend to send 10,000 naira worth of airtime for conversion, they will deduct 30% as their fee, and you will receive 7,000 naira in cash.

Currently, only the Glo network is available for manual airtime conversion, and only the Airtel network is available for instant airtime conversion. Other networks are unavailable, most likely due to network downtimes. You can also transfer up to 5,000 naira daily, with a limit of 1,000 naira on a single transfer.

There are typically no charges for services like funding bets and purchasing airtime or data.

However, remember that some newer features, such as gift card purchases and international airtime or data purchases, come with charges. These charges vary depending on the specific service you request.

Pros and Cons

Check out the pros and cons below:

Pros

- Has a user-friendly interface

- Maintains secure transactions

- Offers competitive rates

- Decent customer support

- Provides multiple services

Cons

- New features attract service charges

- Only available in Nigeria

Security and Legitimacy

AirtimeFlip offers two-factor authentication as an extra layer of security. It sends you a code to your email, which you must confirm and verify that it’s truly you before logging in.

The platform also allows you to create an account password and a 4-digit PIN to secure your transactions and account during the account creation stage.

You can reset your password and 4-digit PIN anytime and choose to activate or deactivate the two-factor authentication.

AirtimeFlip assures its users that it takes their safety seriously and has employed several security protocols to ensure swift and secure transactions.

Also, the app developer has assured users that the mobile app does not collect or share any user data, as this would go contrary to their commitment to user privacy.

According to an assessment by ScamAdviser, AirtimeFlip currently has a trust score of 72/100, indicating a medium to low risk. This evaluation is based on public information such as WHOIS data, server IP addresses, and the absence of spam or phishing lists.

User Experience

AirtimeFlip has a 3.8/5 score on Trustpilot, which indicates that the platform performs well and does what it claims to a reasonable extent.

Here are some of the comments from users below:

“They’re swift and without hitches. I’ve used them countless times. I trust them.” – David Otache

“I was amazed at their excellent service when I gave it a trial.. keep up the good work…” – Eze Joseph Samuel

Based on our experience, the mobile app was generally smooth and hassle-free. The transaction was fast, the rates were transparent, and we didn’t face any issues with delays or missing funds.

We selected our network provider (Glo), entered the amount we wanted to convert (₦20,000), and AirtimeFlip instantly displayed the conversion rate. It showed we would receive ₦14,000 in our bank account due to the 30% transaction fee.

Within eight minutes, we received a notification that our bank account had been credited with ₦14,000. We believe AirtimeFlip is a lifesaver when you mistakenly overbuy airtime or need quick cash.

Best Alternative Platform To Convert Your Airtime To Cash – Prestmit

If you are looking for another place to convert your airtime to cash, consider using Prestmit. This is a full-suite platform on which you can use your cash to pay utility bills.

Prestmit is highly rated by its users and is seen as trusted and reliable. The platform is built with love for its users, so the rate you would find here is the lowest in the market.

In addition, transactions and payments are quick and very fast, and the app is well-secured.

That being said, check out the steps on how to convert your airtime to cash on Prestmit below:

- Download the Prestmit app on Google Play Store or Apple Store

- Create and log into your Prestmit account.

- Click “Sell Airtime” on the feature list and fill in your network provider, phone number, and amount you wish to sell.

- You must transfer the airtime amount to a unique phone number assigned to you. Make the transfer, upload the proof of transaction, and click “Submit,” and you will be ready.

Note: You can only sell airtime from the phone number on your profile. So, ensure you include the phone number with the excess airtime you want to sell when creating an account.

Frequently Asked Questions (FAQs) About AirtimeFlip

Does AirtimeFlip Accept Recharge Card Pins for Airtime Conversion?

No, AirtimeFlip does not accept recharge card pins for airtime conversion. The platform only accepts airtime transfers.

What is the Rate for Converting Airtime to Cash on AirTimeFlip?

AirtimeFlip has stated that it does not have a fixed rate for airtime-to-cash conversion, as the rates on all networks are subject to change. However, as of today, the rate is 30%.

Is There a Stipulated Time for Payment on AirtimeFlip?

Yes, there is. All payments are accepted from 9:00 a.m. to 10:00 p.m. Monday through Saturday and 11:00 a.m. to 9:00 p.m. Sundays and Public holidays.

Conclusion

After thoroughly reviewing AirtimeFlip, it’s clear that the platform offers a legit and reliable way to convert excess airtime into cash.

With its user-friendly interface, fast transactions, and secure payment processing, AirtimeFlip has positioned itself as a convenient solution for those looking to recover mistakenly purchased airtime or liquidate unused credit.

However, while the service is legitimate, you should consider the conversion fees and follow the correct steps to avoid transaction issues. If you’re looking for a quick and efficient airtime-to-cash conversion service, AirtimeFlip is worth a try.

Last updated on August 8, 2025